Introduction:

The stock brokerage industry is a vital component of the financial sector in the United States. As investors seek opportunities to grow their wealth, stock brokers play a crucial role in facilitating these transactions. However, determining the exact number of stock brokers in the US can be challenging. This article delves into the complexities surrounding this question and provides insights into the current landscape of the stock brokerage industry.

Understanding the Stock Broker Industry:

A stock broker is an individual or firm that buys and sells stocks, bonds, and other securities for their clients. They act as intermediaries between investors and the stock market, offering expertise, advice, and execution services. The industry has evolved significantly over the years, with technological advancements and regulatory changes shaping its structure.

Determining the Number of Stock Brokers:

Estimating the precise number of stock brokers in the US is a challenging task due to various factors. The industry is highly fragmented, with brokers ranging from large, well-known firms to individual independent contractors. Additionally, the definition of a stock broker can vary, making it difficult to establish a standardized count.

One approach to estimating the number of stock brokers is to analyze data from the Financial Industry Regulatory Authority (FINRA), which regulates the securities industry in the US. According to FINRA, there were approximately 5,500 registered broker-dealer firms in 2020. However, this figure only represents the entities that have registered with the authority, not the individual brokers working within those firms.

Market Segmentation:

The stock brokerage industry can be segmented into various categories, each catering to different investor needs:

Full-Service Brokers: These brokers provide personalized investment advice and a wide range of services, including financial planning and portfolio management. They typically charge higher fees compared to discount brokers.

Discount Brokers: Discount brokers offer lower fees and a simplified trading experience. They focus on executing trades efficiently without providing extensive investment advice.

Online Brokers: Online brokers have gained popularity due to their ease of access and cost-effectiveness. They provide investors with the tools and resources needed to trade securities on their own.

Independent Brokers: Independent brokers work independently, not affiliated with any specific brokerage firm. They offer personalized services and have the flexibility to work with clients from various industries.

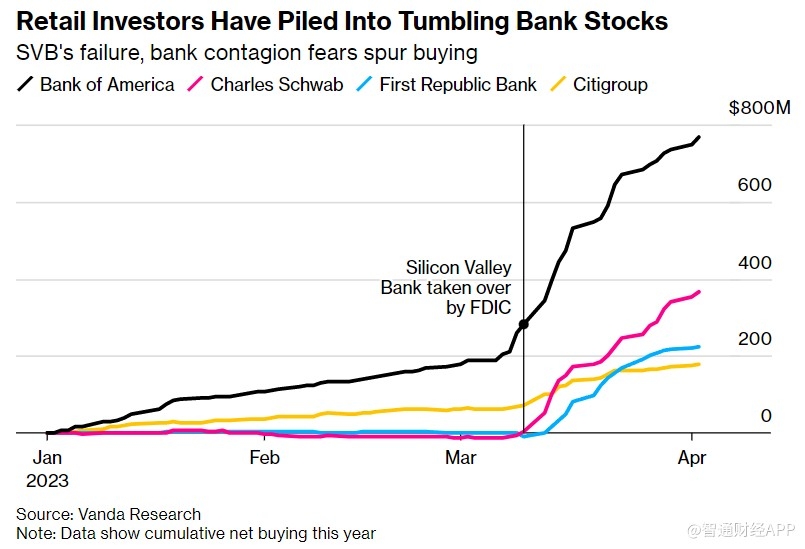

Case Study: Charles Schwab

To better understand the stock brokerage landscape, let's take a look at Charles Schwab, one of the largest and most well-known brokerage firms in the US.

Charles Schwab: A Leading Stock Broker

Charles Schwab, founded in 1971, has grown to become a major player in the stock brokerage industry. The company offers a range of services, including investment management, banking, and advisory services.

Market Share and Growth:

As of 2020, Charles Schwab held a significant market share, with approximately 11.5 million client accounts. The company's revenue exceeded $16 billion, showcasing its strong presence in the industry.

Key Factors Contributing to Schwab's Success:

- Comprehensive Services: Schwab offers a wide range of services, catering to both individual and institutional investors.

- Technological Innovation: The company has invested heavily in technology, providing clients with user-friendly platforms and tools for trading and investment management.

- Regulatory Compliance: Schwab has a strong focus on regulatory compliance, ensuring its clients receive the highest level of service and protection.

Conclusion:

Determining the exact number of stock brokers in the US is a complex task due to the fragmented nature of the industry. However, with approximately 5,500 registered broker-dealer firms and countless individual brokers, the stock brokerage industry continues to play a crucial role in the financial sector. As investors seek opportunities to grow their wealth, the demand for reliable and knowledgeable stock brokers remains strong.

Applied Optoelectronics Inc. Common Stock, ? Us stock information