In the ever-evolving landscape of the US stock market, the S&P 100 index, often referred to as the "Big Cap 100," has been a beacon for investors seeking stability and growth. This article delves into a comprehensive 5-year analysis of the US Stock Market 100, exploring its performance, key trends, and potential future directions.

Understanding the S&P 100

The S&P 100 index is a subset of the S&P 500, representing the top 100 companies by market capitalization. These companies are considered industry leaders and are often seen as a proxy for the overall health of the US stock market. The index includes a diverse range of sectors, from technology and healthcare to finance and consumer goods.

Performance Over the Past 5 Years

Over the past five years, the S&P 100 has demonstrated remarkable resilience and growth. Despite facing various challenges, including the COVID-19 pandemic and economic uncertainties, the index has delivered impressive returns.

Key Trends and Factors

Several key trends and factors have contributed to the S&P 100's performance over the past five years:

- Technology Sector Growth: The technology sector, which accounts for a significant portion of the S&P 100, has been a major driver of growth. Companies like Apple, Microsoft, and Amazon have continued to expand their market share and innovate, leading to strong stock performance.

- Economic Recovery: The US economy has shown significant signs of recovery over the past few years, with low unemployment rates and strong consumer spending. This has positively impacted the S&P 100 companies, particularly those in consumer goods and retail sectors.

- Dividend Yields: The S&P 100 companies have been known for their strong dividend yields, making them attractive to income-seeking investors. This has further contributed to the index's overall performance.

Case Studies

To illustrate the performance of the S&P 100, let's consider a few case studies:

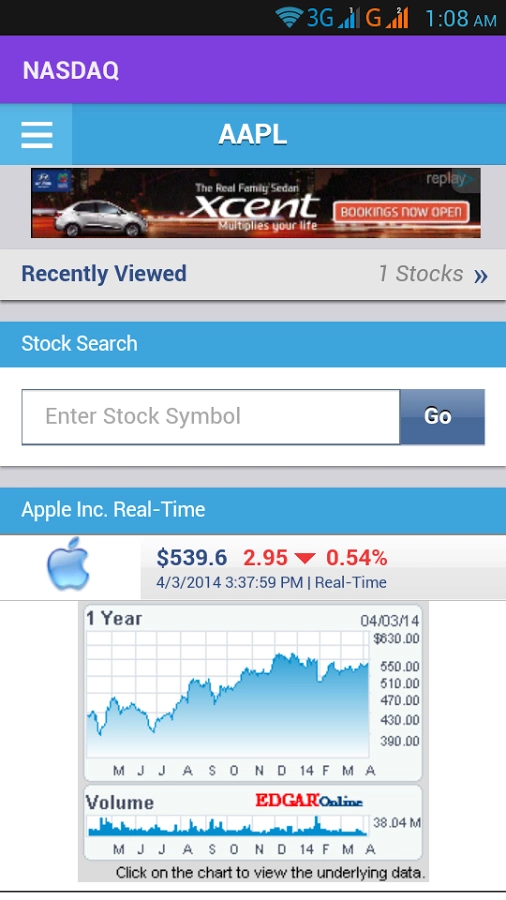

- Apple Inc.: Over the past five years, Apple has been a standout performer, with its stock price increasing by over 60%. This can be attributed to its strong product lineup, global market presence, and continuous innovation.

- Microsoft Corporation: Microsoft has also delivered impressive returns, with its stock price increasing by over 50% over the same period. The company's diversification into cloud computing and other emerging technologies has been a key driver of growth.

- Procter & Gamble Company: Despite facing challenges in the consumer goods sector, P&G has managed to deliver solid returns, with its stock price increasing by over 20% over the past five years. This can be attributed to its focus on cost-cutting and product innovation.

Conclusion

The S&P 100 index has proven to be a robust indicator of the US stock market's performance over the past five years. With its diverse range of industry leaders and strong growth potential, the index remains a key focus for investors seeking stability and growth. As the market continues to evolve, the S&P 100 is poised to play a crucial role in shaping the future of the US stock market.

SAZ Stock: The Ultimate Guide to Understand? Us stock information