Investing in US stocks can be a lucrative venture, but understanding the tax implications is crucial for maximizing your returns. Taxes on US stocks can significantly impact your investment gains, so it’s essential to be well-informed. This article will delve into the key aspects of taxes on US stocks, helping you make informed decisions and optimize your tax strategy.

What Are Taxes on US Stocks?

When you invest in US stocks, you are subject to various taxes, including capital gains tax, dividends tax, and potentially wash sale rules. Understanding these taxes is vital for managing your investment portfolio effectively.

Capital Gains Tax

Capital gains refer to the profit you make from selling an investment for more than its original purchase price. The tax rate on capital gains depends on how long you held the investment.

- Short-term capital gains, which are realized within one year of purchase, are taxed as ordinary income.

- Long-term capital gains, which are realized after one year of purchase, are taxed at lower rates.

For the 2021 tax year, the tax rates on long-term capital gains are:

- 0% for taxable income below

44,625 for single filers and 89,250 for married filing jointly. - 15% for taxable income above these thresholds.

- 20% for higher-income taxpayers.

Dividends Tax

Dividends are distributions of a company's profits to its shareholders. The tax treatment of dividends depends on the type of dividend and your income level.

- Qualified dividends are taxed at the lower long-term capital gains rates.

- Non-qualified dividends are taxed as ordinary income.

To qualify for the lower tax rate on qualified dividends, the stock must meet specific criteria, such as holding the stock for a minimum period and being a U.S. corporation.

Wash Sale Rule

The wash sale rule prevents investors from recognizing a capital loss on a stock they sold at a loss and immediately repurchasing the same or a "substantially identical" security. If you sell a stock at a loss and repurchase it within 30 days before or after the sale, the IRS will disallow the loss and add the disallowed amount to your cost basis of the new stock.

Tax Strategies for US Stock Investors

Here are some strategies to help you minimize taxes on US stocks:

- Long-term investments: Hold investments for more than one year to qualify for the lower long-term capital gains rates.

- Tax-efficient investing: Consider investing in tax-efficient funds or exchange-traded funds (ETFs) that minimize taxable distributions.

- Understanding holding periods: Be aware of the holding periods for qualified dividends and avoid triggering the wash sale rule.

- Tax-loss harvesting: Sell investments at a loss to offset capital gains and reduce your tax liability.

Case Study: Tax-Efficient Investing

Consider an investor who holds a diversified portfolio of US stocks. By understanding the tax implications of their investments, they can implement tax-efficient strategies such as holding investments for the long term and utilizing tax-loss harvesting to minimize their tax burden.

By educating yourself on the taxes on US stocks, you can make informed decisions and optimize your tax strategy. Remember to consult with a tax professional for personalized advice tailored to your investment goals and circumstances.

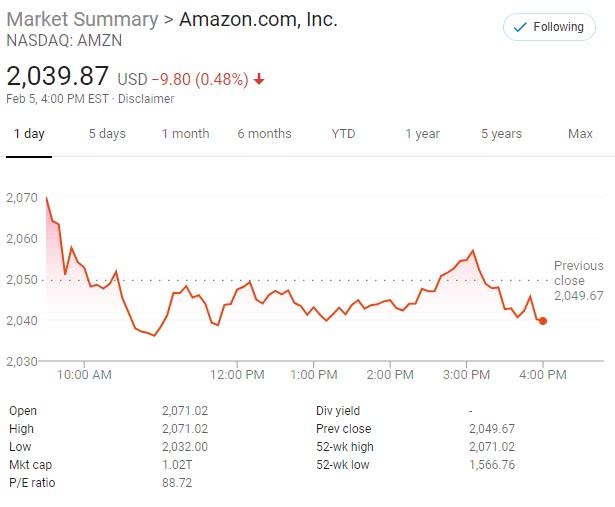

Artius II Acquisition Inc. Class A Ordinary? Us stock information