In the bustling world of real estate investment, hotel stocks have always been a hot commodity. The United States, with its diverse and vibrant hospitality industry, offers a plethora of opportunities for investors looking to capitalize on the thriving hotel sector. This article delves into the current state of hotel stocks in the US, highlighting key trends, potential growth areas, and the factors that could impact their performance.

The Current State of Hotel Stocks

The hotel industry in the US has seen a remarkable recovery since the pandemic. As the economy continues to bounce back, demand for travel and hospitality services is on the rise. This has translated into a strong performance for hotel stocks, with many companies reporting robust revenue growth and improved profitability.

Key Trends in Hotel Stocks

Recovery from Pandemic: The hotel industry has fully recovered from the pandemic's impact, with occupancy rates and average daily rates (ADR) reaching pre-pandemic levels. This trend is expected to continue as the US economy strengthens.

Mergers and Acquisitions: The hotel industry has seen a surge in mergers and acquisitions, with major players looking to expand their portfolios and increase market share. This trend is likely to continue as consolidation becomes a key strategy for growth.

Technology Integration: Hotel companies are increasingly investing in technology to improve customer experience and operational efficiency. This includes the use of mobile apps, online booking platforms, and AI-driven chatbots.

Potential Growth Areas

Urban Markets: Major urban centers like New York, Los Angeles, and Chicago offer significant growth opportunities due to their high demand for hotel rooms and strong economic fundamentals.

Resort Markets: Resort destinations such as Las Vegas, Orlando, and Miami are expected to see strong growth as travel and leisure demand increases.

Value-Driven Brands: As consumers seek more affordable travel options, value-driven hotel brands are poised to benefit from increased demand.

Factors Impacting Hotel Stocks

Economic Conditions: The health of the US economy is a crucial factor in the performance of hotel stocks. A strong economy typically leads to higher demand for travel and hospitality services.

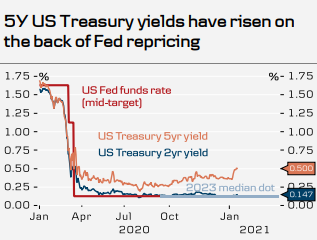

Interest Rates: Rising interest rates can impact the cost of borrowing for hotel companies, potentially affecting their profitability.

Regulatory Changes: Changes in regulations, particularly those related to labor and environmental issues, can impact the operations and profitability of hotel companies.

Case Studies

Marriott International: Marriott has been a leader in the hotel industry, with a strong focus on technology integration and global expansion. The company's stock has seen significant growth over the past few years, driven by its robust performance and strategic investments.

Hilton Worldwide: Hilton has been aggressive in acquiring new properties and expanding its portfolio. The company's stock has also seen strong growth, driven by its strong brand recognition and global presence.

In conclusion, hotel stocks in the US offer a promising investment opportunity, driven by the industry's strong recovery and promising growth prospects. As investors continue to seek opportunities in the real estate sector, hotel stocks are likely to remain a key focus area.

AA Mission Acquisition Corp. Class A Ordina? Us stock information