In the ever-evolving energy sector, U.S. oil refineries stocks have emerged as a lucrative investment opportunity. As the world's largest oil-consuming nation, the United States has a robust refining industry that plays a crucial role in the global energy market. This article delves into the key aspects of U.S. oil refineries stocks, highlighting their potential and offering insights into the factors that influence their performance.

Understanding U.S. Oil Refineries Stocks

U.S. oil refineries stocks represent shares of companies involved in the refining and processing of crude oil into various petroleum products. These products include gasoline, diesel, jet fuel, and other petrochemicals. The refining process is essential for the distribution of oil products across the country, making the industry a vital component of the U.S. economy.

Market Dynamics and Growth Opportunities

The U.S. refining industry has experienced significant growth over the past decade, driven by factors such as increased domestic oil production, favorable regulatory environments, and advancements in refining technology. Here are some key factors that have contributed to the growth of U.S. oil refineries stocks:

- Rising Domestic Oil Production: The U.S. has witnessed a surge in domestic oil production, particularly from shale formations like the Permian Basin. This abundance of oil has created a more stable supply of crude, leading to lower feedstock costs for refineries.

- Regulatory Environment: The U.S. government has implemented policies that promote the refining industry, including tax incentives and environmental regulations that encourage the use of cleaner technologies.

- Advancements in Refining Technology: Refineries have adopted advanced technologies to improve efficiency and reduce emissions. These innovations have enabled refineries to produce more valuable products and increase profitability.

Key Players in the U.S. Oil Refining Industry

Several companies dominate the U.S. oil refining industry, including:

- ExxonMobil: As one of the world's largest publicly traded oil and gas companies, ExxonMobil operates numerous refineries across the United States.

- Chevron: Another major player in the industry, Chevron operates refineries in various regions, including the Gulf Coast and the West Coast.

- Valero Energy: Valero Energy is one of the largest independent oil refiners in the United States, with a significant presence in the Gulf Coast region.

Investment Opportunities and Risks

Investing in U.S. oil refineries stocks can offer attractive returns, but it's essential to understand the associated risks. Here are some key factors to consider:

- Commodity Prices: The price of crude oil and other petroleum products can significantly impact the profitability of refineries. Fluctuations in commodity prices can lead to volatility in stock prices.

- Regulatory Changes: Changes in environmental regulations can affect the operations and profitability of refineries.

- Economic Factors: Economic conditions, such as recessions or high unemployment rates, can reduce demand for oil products, affecting the performance of refineries.

Case Study: Marathon Petroleum Corporation

One notable example of a successful U.S. oil refinery stock is Marathon Petroleum Corporation. Marathon has capitalized on the growth of the refining industry by investing in new technologies and expanding its refining capacity. The company's focus on operational efficiency and strategic acquisitions has contributed to its strong financial performance.

Conclusion

U.S. oil refineries stocks present a compelling investment opportunity for those looking to capitalize on the growth of the refining industry. By understanding the key factors that influence the performance of these stocks, investors can make informed decisions and potentially achieve substantial returns. However, it's crucial to monitor market conditions and stay informed about regulatory changes and economic factors that could impact the industry.

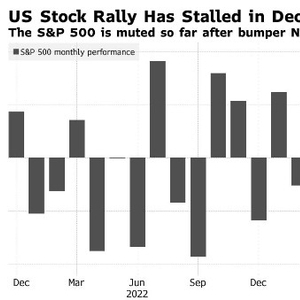

Yahoo S&P: Exploring the Intersecti? Us stock information