Introduction

Wall Street, the financial district of New York City, is a symbol of wealth, power, and opportunity. For centuries, it has been the epicenter of global finance, attracting investors, traders, and entrepreneurs from around the world. Whether you're a seasoned investor or just starting out, understanding the intricacies of Wall Street is crucial for making informed financial decisions. In this article, we'll delve into the history, key players, and strategies that make Wall Street a force to be reckoned with.

The History of Wall Street

Wall Street's origins date back to the 17th century when the Dutch settled in New Amsterdam. Over the years, it has evolved from a simple trading post to a bustling financial hub. The New York Stock Exchange (NYSE), founded in 1792, is the oldest and largest stock exchange in the world. It has played a pivotal role in shaping the financial landscape, fostering innovation, and driving economic growth.

Key Players on Wall Street

Several key players have shaped Wall Street's history and continue to influence its future. These include:

- Investment Banks: Firms like Goldman Sachs, JPMorgan Chase, and Morgan Stanley provide a wide range of financial services, including investment banking, asset management, and trading.

- Brokers: Brokers facilitate the buying and selling of stocks, bonds, and other securities on behalf of their clients.

- Hedge Funds: These private investment funds pool capital from high-net-worth individuals and institutions to invest in a diverse range of assets.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities.

Strategies for Success on Wall Street

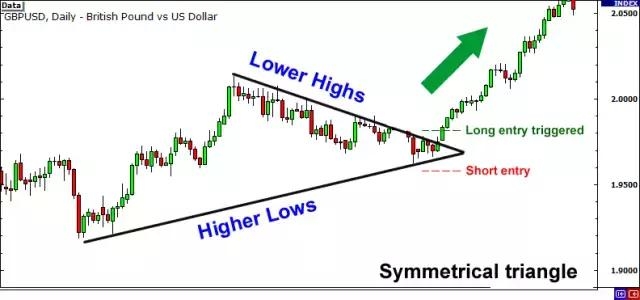

To succeed on Wall Street, investors need to adopt a well-thought-out strategy. Here are some key strategies to consider:

- Diversification: Diversify your portfolio to reduce risk and maximize returns. This involves investing in a variety of assets, industries, and geographical regions.

- Research: Conduct thorough research before making investment decisions. This includes analyzing financial statements, understanding market trends, and staying informed about economic indicators.

- Risk Management: Manage your risk by setting stop-loss orders, diversifying your portfolio, and avoiding high-risk investments.

- Continuous Learning: The financial markets are constantly evolving, so it's crucial to stay informed and adapt to new trends and technologies.

Case Studies

To illustrate the impact of Wall Street, let's look at a few case studies:

- Facebook's IPO: In 2012, Facebook became the largest tech IPO in history, raising $16 billion. This event highlighted the potential of social media as a lucrative investment opportunity.

- Tesla's Rise: Tesla's stock has surged in recent years, making it one of the most valuable companies in the world. This rise can be attributed to the company's innovative approach to electric vehicles and renewable energy.

Conclusion

Wall Street is a complex and dynamic marketplace that requires a deep understanding of financial markets and investment strategies. By following the principles outlined in this article, investors can navigate the challenges and opportunities of Wall Street with confidence. Whether you're looking to grow your wealth or simply gain a better understanding of the financial world, Wall Street offers a wealth of opportunities.

TSINGTAO BREWERY CO LTD H Stock: Unveiling ? Us stock information