The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," has been making headlines as it continues to climb. Investors are buzzing with questions: What's driving this surge? This article delves into the key factors contributing to the upward trend of the Dow Jones today.

Economic Indicators and Data

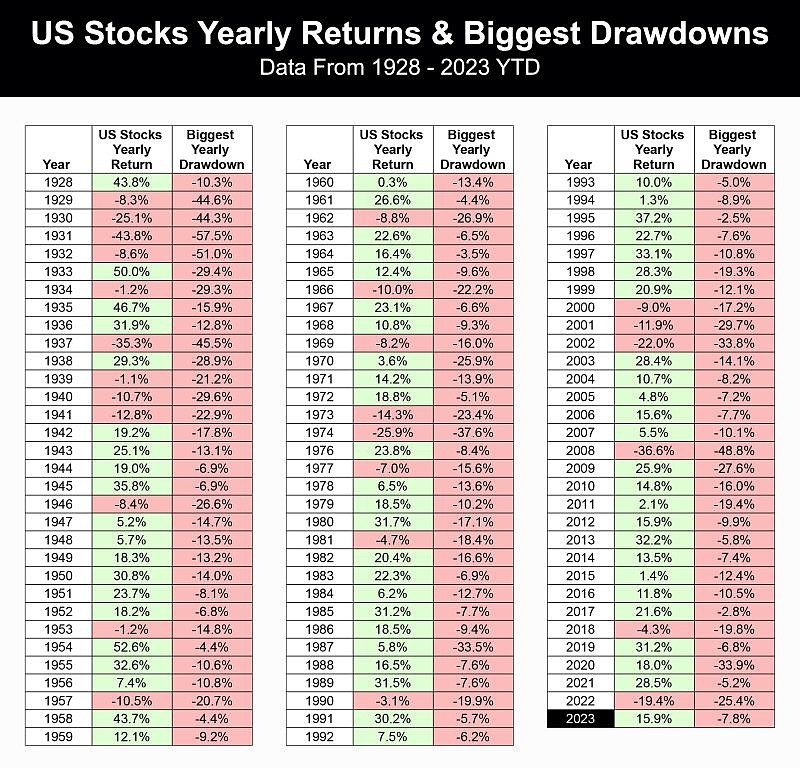

One of the primary reasons for the Dow's rise is the positive economic indicators and data released recently. GDP growth, consumer spending, and low unemployment rates have all played a crucial role in boosting investor confidence. For instance, the latest GDP report showed a strong growth rate, indicating a robust economy, which is a positive sign for the stock market.

Corporate Earnings

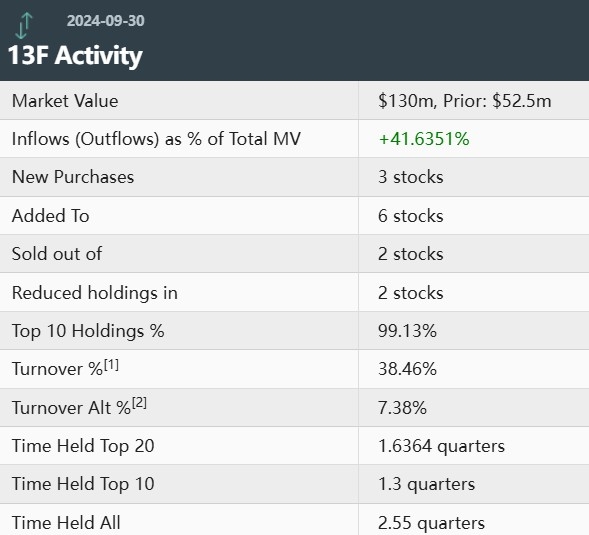

Corporate earnings have also been a major factor in the Dow's upward trend. Many companies have reported better-than-expected earnings, which has led to increased optimism among investors. This positive sentiment is driving up stock prices and, subsequently, the Dow.

Global Economic Outlook

The global economic outlook is also contributing to the rise in the Dow. International markets have been performing well, which has had a ripple effect on the US market. Countries like China and Germany have shown signs of economic recovery, which is beneficial for the global economy and, by extension, the US stock market.

Federal Reserve Policy

Federal Reserve policy has also played a role in the Dow's rise. The Fed has been implementing expansionary monetary policy, including keeping interest rates low, which has been supportive of the stock market. Lower interest rates make borrowing cheaper, which can stimulate economic activity and boost stock prices.

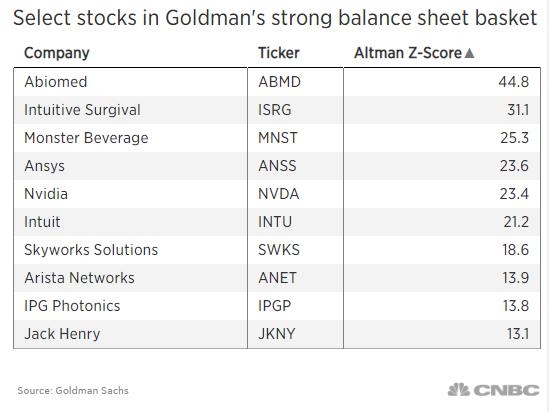

Sector Performance

Several sectors have been leading the charge in the Dow's rise. The technology sector, for example, has seen significant growth due to strong earnings from major companies like Apple and Microsoft. Additionally, the energy sector has been performing well, thanks to the rise in oil prices and increased production.

Market Sentiment

Lastly, market sentiment has been a major driver of the Dow's rise. Investors have been feeling increasingly optimistic about the future of the stock market, which has led to increased buying activity. This positive sentiment has created a self-fulfilling prophecy, as rising stock prices have further fueled optimism.

Case Study: Apple's Impact on the Dow

A prime example of how individual companies can impact the Dow is the case of Apple. The tech giant's recent earnings report showed strong sales and profits, which sent its stock price soaring. Since Apple is a component of the Dow, this increase in its stock price had a direct impact on the overall index.

In conclusion, the Dow Jones' rise today can be attributed to a combination of factors, including positive economic indicators, strong corporate earnings, a favorable global economic outlook, expansionary monetary policy, sector performance, and market sentiment. These factors have collectively created a bullish environment for the stock market, leading to the Dow's upward trend.

ATA Creativity Global American Depositary S? Us stock information