In recent years, the U.S. stock market has seen a surge in growth, prompting many investors to question whether it's currently overvalued. With the S&P 500 reaching record highs, it's crucial to analyze the current market conditions and determine if investors should be cautious or optimistic.

Understanding Market Valuation

Market valuation is a measure used to determine whether a stock or the entire market is overpriced or undervalued. It's essential to consider various factors, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio, to assess market valuation.

Price-to-Earnings (P/E) Ratio

The P/E ratio is one of the most popular metrics used to measure market valuation. It compares a company's stock price to its earnings per share (EPS). A high P/E ratio indicates that investors are willing to pay a premium for the company's earnings, which may suggest overvaluation.

Currently, the S&P 500's P/E ratio stands at around 22, which is above its long-term average of 16. This indicates that the market may be slightly overvalued, but it's not necessarily a cause for concern.

Price-to-Book (P/B) Ratio

The P/B ratio compares a company's stock price to its book value per share. A high P/B ratio suggests that the market is valuing the company's assets more highly than its book value, which could indicate overvaluation.

The S&P 500's P/B ratio is currently around 3.4, which is above its long-term average of 2.0. This suggests that the market may be overvalued in terms of book value, but it's still not a clear indication of overvaluation.

Price-to-Sales (P/S) Ratio

The P/S ratio compares a company's stock price to its revenue per share. A high P/S ratio suggests that investors are willing to pay a premium for the company's sales, which may indicate overvaluation.

The S&P 500's P/S ratio is currently around 3.2, which is above its long-term average of 1.5. This suggests that the market may be overvalued in terms of sales, but it's not a definitive indicator.

Economic Factors

Several economic factors contribute to the current market conditions. One of the primary factors is the low-interest rate environment, which has pushed investors towards riskier assets, such as stocks. Additionally, the strong U.S. economy and corporate earnings have supported the stock market's growth.

Sector Analysis

It's essential to analyze different sectors to determine if they are overvalued or undervalued. For instance, the technology sector has seen significant growth, with some companies, like Apple and Microsoft, reaching record highs. However, some sectors, like energy and real estate, may be undervalued.

Case Study: Tesla

One case study worth mentioning is Tesla, an electric vehicle manufacturer. Despite its strong performance, Tesla's stock has seen massive volatility, with the share price skyrocketing and crashing multiple times. This volatility suggests that the stock may be overvalued, as investors are driven by sentiment rather than fundamentals.

Conclusion

In conclusion, the U.S. stock market may be slightly overvalued, but it's essential to consider various factors before making any conclusions. While some metrics suggest overvaluation, others indicate that the market is still in a strong position. Investors should weigh the risks and rewards before making investment decisions.

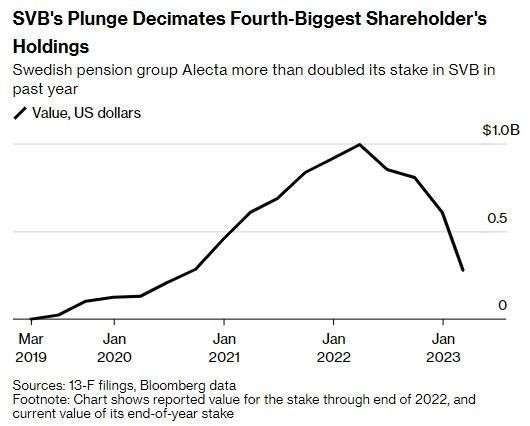

FNMAH Stock: A Comprehensive Guide to Under? Us stocks plummet