Do you ever wonder about the financial investments of the U.S. government? One question that often arises is whether the government owns stock in various companies. In this article, we'll delve into this topic, exploring how the government invests its funds and whether it holds stock in private companies.

The Government's Investment Portfolio

The U.S. government manages a substantial investment portfolio, primarily through various government funds and agencies. One of the most significant investors is the Treasury Department, which manages the Government Securities Act. This act authorizes the Treasury to issue securities to finance government spending and operations.

The primary goal of these investments is to generate returns that help cover government expenses. These returns are then used to fund government programs and services. While the government does not typically invest in individual stocks, it does hold shares in a few select companies through its various investment vehicles.

Government Investments in Corporate Stocks

The government's direct ownership of corporate stocks is relatively limited. However, it does have indirect investments through various programs. One of the most notable examples is the Government Employees Retirement System (FERS), which holds a portion of its assets in corporate stocks. The FERS is a retirement plan for federal employees, and its investment strategy includes a mix of stocks, bonds, and other securities.

Another example is the Federal Employees Retirement System (FERS), which includes a Thrift Savings Plan (TSP). The TSP offers federal employees the option to invest in a mix of funds, including stock funds. As a result, the government indirectly invests in corporate stocks through the retirement accounts of its employees.

Cases of Direct Ownership

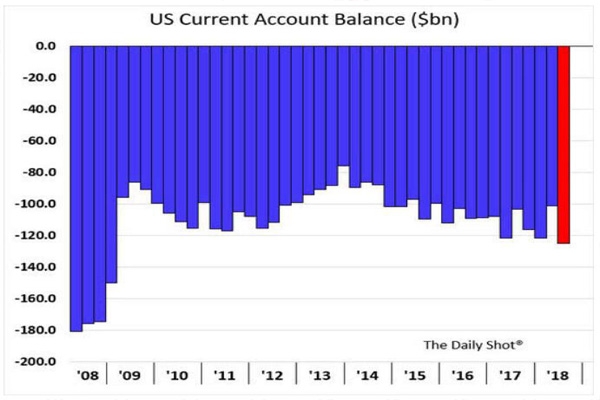

While direct ownership of corporate stocks is rare, there have been a few instances where the government has taken direct stakes in companies. One notable example is the Government Motors bailout during the financial crisis of 2008. As part of the bailout, the U.S. government acquired a significant stake in General Motors, which it eventually sold off.

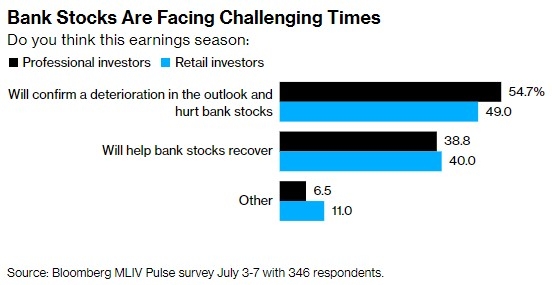

Another example is the TARP (Troubled Asset Relief Program), which provided financial assistance to various companies, including banks and automakers. While TARP was primarily designed to stabilize the financial system, it also resulted in the government owning a portion of some companies.

Conclusion

In conclusion, while the U.S. government does not typically own stock in companies, it does manage a significant investment portfolio through various funds and programs. These investments help finance government operations and provide returns that fund government programs and services. While direct ownership of corporate stocks is rare, there have been instances where the government has taken stakes in specific companies, primarily to address financial crises. Understanding these investments can provide insight into the government's financial strategies and the role of investment in public policy.

Artius II Acquisition Inc. Class A Ordinary? Us stocks plummet