Introduction: Are you looking to invest in NOK stock but unsure about its current price and potential? In this article, we will delve into the NOK stock price in the US, exploring its historical trends, current market conditions, and future prospects. Whether you are a seasoned investor or just starting out, understanding the intricacies of NOK stock price is crucial for making informed investment decisions.

Understanding NOK Stock: NOK stands for Norwegian Krone, which is the official currency of Norway. The NOK stock price refers to the value of Norwegian Krone against other currencies, particularly the US Dollar. This stock price fluctuates based on various economic and political factors, making it an essential indicator for investors.

Historical Trends: Over the past few years, the NOK stock price has exhibited a volatile pattern, influenced by global economic conditions. In the early 2010s, the NOK experienced a significant appreciation against the US Dollar, driven by strong economic growth in Norway. However, in recent years, the NOK has faced downward pressure due to global economic uncertainty and lower oil prices.

Current Market Conditions: As of the latest data, the NOK stock price in the US has been hovering around 0.10 USD. This exchange rate reflects the current market conditions, where the NOK has weakened against the US Dollar. Several factors contribute to this trend, including geopolitical tensions, global economic slowdown, and low oil prices.

Key Factors Affecting NOK Stock Price:

- Oil Prices: Norway is one of the world's largest oil producers, and fluctuations in oil prices have a significant impact on the NOK stock price. Higher oil prices tend to strengthen the NOK, while lower prices weaken it.

- Economic Growth: The overall economic growth in Norway plays a crucial role in determining the NOK stock price. Strong economic growth leads to higher demand for the NOK, boosting its value.

- Political Stability: Norway's political stability is another factor influencing the NOK stock price. Any political unrest or instability can lead to a depreciation of the NOK.

- Interest Rates: Interest rate differentials between Norway and other countries can affect the NOK stock price. Higher interest rates in Norway tend to strengthen the NOK, while lower rates can weaken it.

Future Prospects: Predicting the future of the NOK stock price is challenging due to its dependence on various global and domestic factors. However, some experts believe that the NOK may strengthen in the long term, driven by factors such as increased oil production and economic diversification in Norway.

Conclusion: Understanding the NOK stock price in the US is essential for investors looking to invest in Norwegian Krone. By analyzing historical trends, current market conditions, and key factors affecting the NOK stock price, investors can make more informed decisions. While predicting the future is uncertain, staying informed and monitoring global economic and political developments is crucial for long-term success in the stock market.

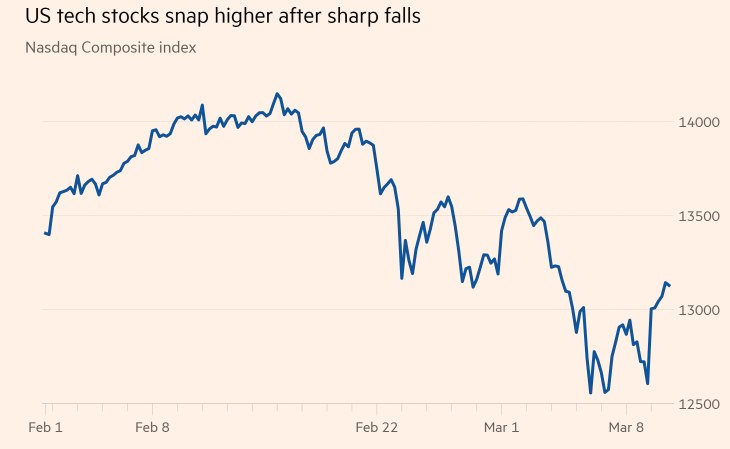

CCCMF Stock: A Deep Dive into the Financial? Us stocks plummet