In today's fast-paced financial world, trading CFDs (Contracts for Difference) on US stocks has become a popular choice for investors seeking high leverage and diverse investment opportunities. If you're considering venturing into this dynamic market, it's crucial to understand the ins and outs of CFD brokers that specialize in US stocks. This article will serve as your comprehensive guide, highlighting key aspects to consider when choosing a CFD broker for trading US stocks.

Understanding CFD Brokers

A CFD broker acts as an intermediary between you and the financial markets, enabling you to trade US stocks without owning the actual shares. By entering into a contract with the broker, you can profit from the price movements of the underlying assets, such as stocks, indices, commodities, and currencies. CFD trading offers several advantages, including:

- High Leverage: CFD brokers typically offer high leverage, allowing you to trade larger positions than your actual capital. This can amplify your returns but also increase your risk.

- Low Margin Requirements: CFD trading requires a relatively small amount of capital compared to traditional stock trading, making it accessible to retail investors.

- 24/7 Trading: CFD brokers provide round-the-clock trading opportunities, enabling you to trade US stocks at any time of the day.

Key Factors to Consider When Choosing a CFD Broker for US Stocks

When selecting a CFD broker for trading US stocks, several crucial factors should be taken into account:

- Regulation and Trustworthiness: Ensure that the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. This ensures that the broker adheres to strict regulatory standards and provides a secure trading environment.

- Trading Platforms: Look for a broker that offers a user-friendly and reliable trading platform, such as MetaTrader 4 or 5, or a proprietary platform. The platform should offer advanced charting tools, technical indicators, and seamless execution of trades.

- Spreads and Fees: Compare the spreads and fees charged by different brokers. Tight spreads and low fees can significantly impact your profitability.

- Customer Support: Choose a broker that provides responsive and helpful customer support, available through various channels, including phone, email, and live chat.

- Educational Resources: A good CFD broker should offer a range of educational resources, such as tutorials, webinars, and market analysis, to help you improve your trading skills.

Top CFD Brokers for US Stocks

Several CFD brokers have established themselves as leading providers of US stock trading services. Here are some of the top choices:

- Plus500: A popular CFD broker offering a wide range of US stocks and a user-friendly trading platform.

- eToro: Known for its social trading features, eToro allows you to copy the trades of successful traders and trade US stocks alongside them.

- IG: A well-regulated broker with a strong reputation for providing reliable trading platforms and comprehensive educational resources.

Conclusion

Trading CFDs on US stocks can be a rewarding investment strategy, but it's crucial to choose the right CFD broker to maximize your chances of success. By considering the factors outlined in this article and selecting a reputable broker, you can take the first step towards becoming a successful CFD trader.

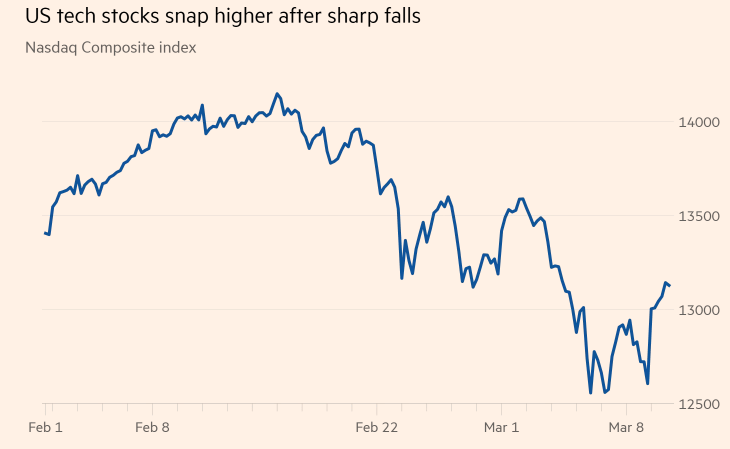

Understanding the SiriusPoint Ltd. 8.00% Re? Us stocks plummet