Investing in stocks can be a challenging endeavor, especially when trying to identify companies with significant potential for growth. One effective strategy is to focus on companies with upcoming catalysts—events or developments that are likely to positively impact their stock price. In this article, we will explore some US stocks with promising upcoming catalysts to keep an eye on.

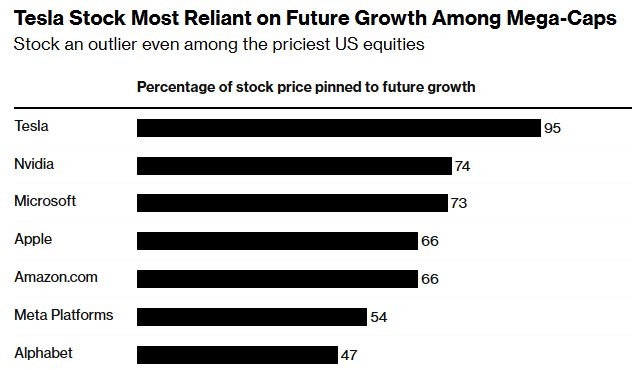

Tesla, Inc. (TSLA)

Tesla, the leading electric vehicle (EV) manufacturer, has a plethora of catalysts on the horizon. One of the most significant catalysts is the opening of its new gigafactory in Germany, which is expected to boost production and reduce costs. Additionally, Tesla’s ongoing expansion into the Chinese market and its new Cybertruck model could drive substantial growth.

Amazon.com, Inc. (AMZN)

As the world's largest online retailer, Amazon has a track record of innovation and disruption. An upcoming catalyst for Amazon is the expansion of its Amazon Web Services (AWS) cloud computing platform, which is expected to generate significant revenue growth. Furthermore, the company's ongoing investment in logistics and delivery infrastructure could further enhance its competitive advantage.

Bristol Myers Squibb (BMY)

Bristol Myers Squibb is a biopharmaceutical company with a pipeline of promising drug candidates. One of the most significant catalysts for BMY is the potential approval of its cancer drug, zanubrutinib, which has shown promising results in clinical trials. If approved, zanubrutinib could become a major revenue driver for the company.

Case Study: Netflix, Inc. (NFLX)

Netflix, the streaming giant, serves as a prime example of a company that has successfully leveraged upcoming catalysts to drive stock price growth. In the early 2010s, Netflix faced significant competition and subscriber losses. However, the company managed to navigate these challenges by launching original content, which helped it regain its competitive edge. This strategic move turned out to be a major catalyst for NFLX, leading to substantial stock price appreciation.

Investment Strategy

When considering companies with upcoming catalysts, it is crucial to conduct thorough research and assess the potential risks. Here are some key factors to consider:

- Market Trends: Identify industries with strong growth potential.

- Company Fundamentals: Evaluate the financial health and growth prospects of the company.

- Catalyst Strength: Assess the likelihood and potential impact of the upcoming catalyst.

- Risk Management: Develop a diversified investment strategy to mitigate risks.

In conclusion, companies with upcoming catalysts can offer significant investment opportunities. By identifying and analyzing these catalysts, investors can make informed decisions and potentially achieve substantial returns. As always, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

BROOKFIELD CP PREF A 40 Stock Trend Followi? Us stocks plummet