The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," is one of the most closely watched stock market indices in the United States. Tracking the performance of 30 large, publicly-owned companies, the DJIA is a vital indicator of the broader market's health. In this article, we delve into the DJIA's performance over the last five days, offering insights and analysis to help readers understand the current market trends.

Understanding the Recent Movement

Over the past five days, the DJIA has experienced a rollercoaster of emotions. Let's take a closer look at the key events and factors that have influenced its performance.

1. Economic Data and Earnings Reports

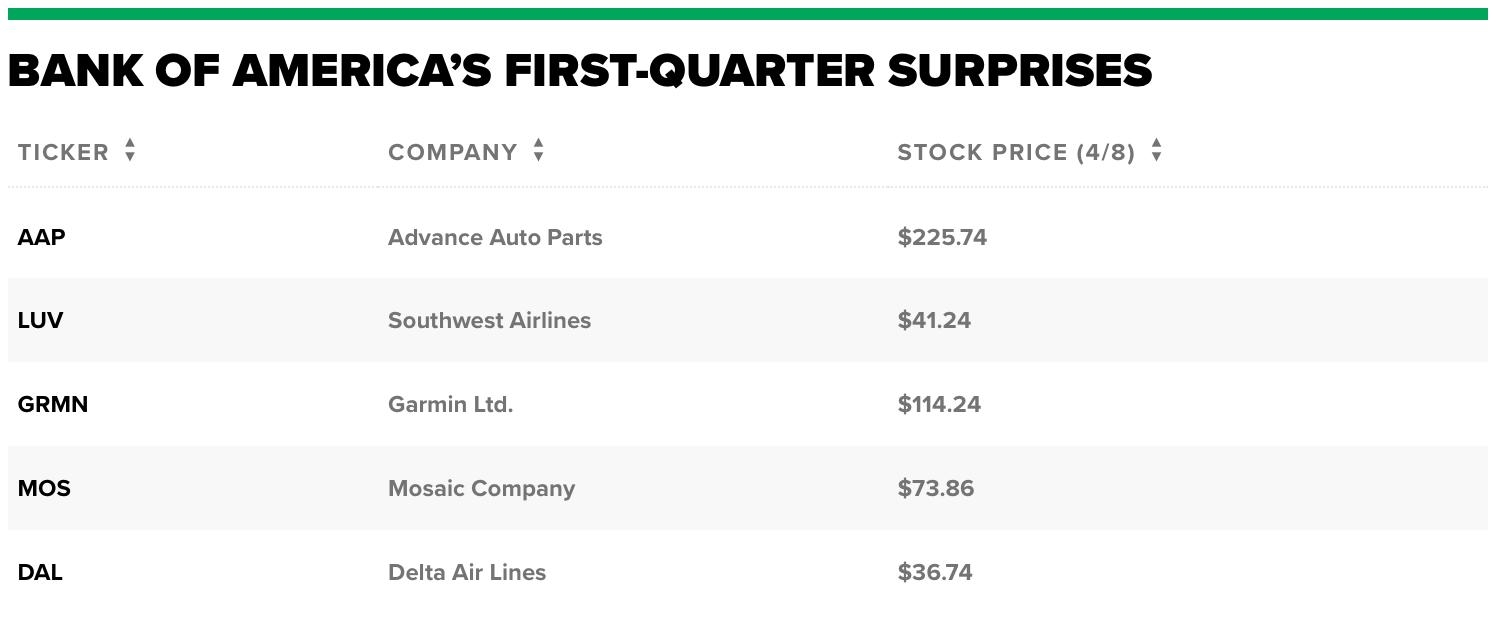

One of the primary factors affecting the DJIA's movement is economic data and earnings reports. In the past week, we've seen a mix of positive and negative economic indicators, with several companies reporting their quarterly earnings.

2. Global Events and Geopolitical Tensions

Global events and geopolitical tensions also play a significant role in the DJIA's performance. Recent tensions in the Middle East and trade negotiations between the United States and China have caused fluctuations in the market.

3. Sentiment and Market Expectations

Market sentiment and expectations are crucial in understanding the DJIA's movement. Investors' optimism or pessimism can lead to significant price changes in a short period.

Key Highlights of the Last 5 Days

1. Volatility in the Market

The past five days have been marked by high volatility in the DJIA. The index has seen sharp ups and downs, reflecting the uncertainty in the market.

2. Record Highs and Lows

The DJIA has set new record highs and lows over the past week. These record-setting numbers indicate the significant impact of various factors on the index.

3. Sector Performance

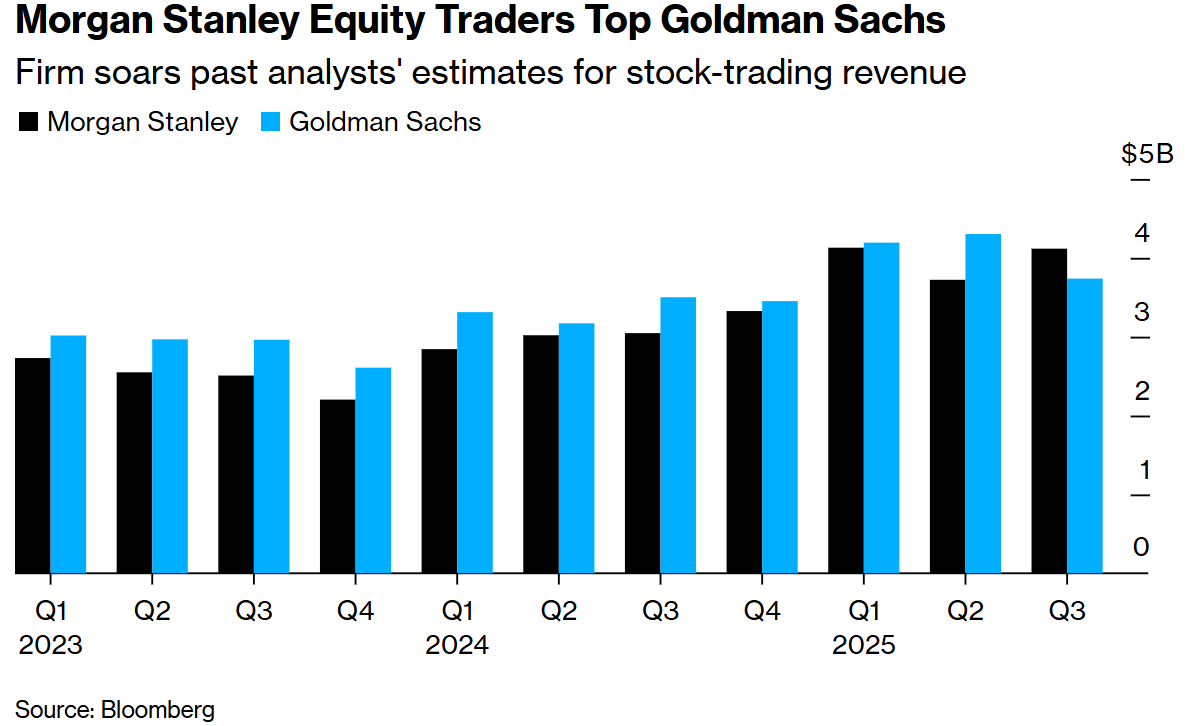

Different sectors within the DJIA have shown varying levels of performance. For instance, technology and financial sectors have been the major contributors to the index's rise, while energy and industrial sectors have struggled.

Case Study: Apple Inc.

A prime example of the impact of individual companies on the DJIA is the case of Apple Inc. Over the past five days, Apple's stock has surged, contributing significantly to the DJIA's overall performance.

Analysis and Predictions

Given the recent trends and factors influencing the DJIA, here are some predictions for the coming days:

- Economic Data: The upcoming economic data could play a crucial role in determining the DJIA's direction.

- Global Events: The resolution of geopolitical tensions could bring stability to the market.

- Market Sentiment: Investors' sentiment will remain a key driver of the DJIA's movement.

In conclusion, the DJIA's performance over the last five days has been influenced by a variety of factors. By understanding these factors and keeping an eye on market trends, investors can make informed decisions. As always, it's crucial to stay updated with the latest news and developments to navigate the ever-changing stock market landscape.

"NY Times Less Stock in US Market&? Us stocks plummet