In the intricate dance of financial markets, the relationship between bond yields and stock market performance is a critical factor for investors to understand. U.S. bond yields, specifically, can significantly influence stock market trends. This article delves into how these yields impact the stock market, providing insights into the dynamics of this relationship.

Understanding Bond Yields

Firstly, let's clarify what bond yields are. Bond yields represent the return an investor can expect from holding a bond. They are typically expressed as an annual percentage rate and are influenced by various factors, including the bond's maturity, credit risk, and market conditions.

When bond yields rise, it generally indicates that investors are demanding higher returns to compensate for the increased risk. Conversely, when bond yields fall, it suggests that investors are willing to accept lower returns due to a more favorable economic outlook or a flight to safety.

Impact on Stock Market

The relationship between bond yields and the stock market is complex and multifaceted. Here are some key ways in which bond yields can affect stock market performance:

1. Valuation Metrics

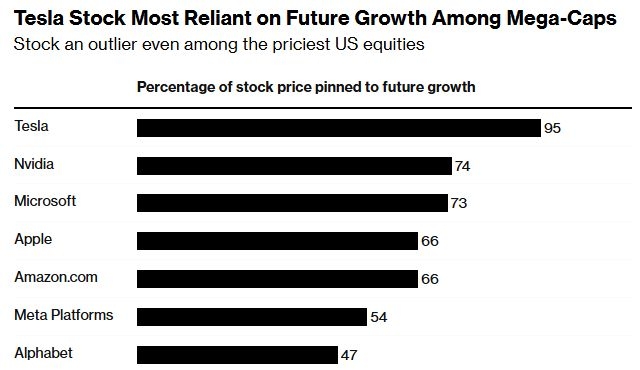

Bond yields have a direct impact on valuation metrics such as the price-to-earnings (P/E) ratio. When bond yields rise, the P/E ratio tends to fall, making stocks relatively more expensive. This is because higher bond yields make the required rate of return for stocks more attractive, leading to increased demand and higher prices.

2. Risk Appetite

Bond yields can also influence investor risk appetite. When bond yields are high, it indicates a more cautious economic outlook, which can lead to a decrease in investor risk appetite. This often results in a shift from stocks to bonds, causing stock prices to decline.

Conversely, when bond yields are low, it suggests a more optimistic economic outlook, leading to increased investor risk appetite. This can drive stock prices higher as investors are more willing to take on risk.

3. Cost of Capital

The cost of capital is another critical factor influenced by bond yields. When bond yields are high, the cost of capital for companies increases, making it more expensive for them to finance projects and expansions. This can lead to a decrease in earnings and, subsequently, stock prices.

4. Inflation Expectations

Bond yields also reflect inflation expectations. When bond yields rise, it suggests that inflation expectations are increasing. Higher inflation can erode the purchasing power of earnings, leading to a decrease in stock prices.

Case Studies

To illustrate the impact of bond yields on the stock market, let's consider a few case studies:

- In 2013, when the Federal Reserve announced its plan to taper its quantitative easing program, bond yields rose significantly. This led to a sell-off in the stock market, as investors became concerned about the potential for higher interest rates and a slower economic recovery.

- In 2020, when the COVID-19 pandemic caused a sharp drop in bond yields, the stock market experienced a significant rally. This was driven by expectations of aggressive monetary policy and increased government spending to stimulate the economy.

In conclusion, U.S. bond yields play a crucial role in shaping stock market trends. Understanding the relationship between bond yields and the stock market can help investors make informed decisions and navigate the complex financial landscape. By keeping a close eye on bond yields and their potential impact on the stock market, investors can better position themselves for success.

SST Stock: A Comprehensive Guide to Underst? Us stocks plummet