Are you interested in investing in the US stock market but don't know where to start? Buying stocks can be a great way to grow your wealth over time, but it's important to do it correctly. In this article, we'll guide you through the process of buying stocks in the US market, from opening a brokerage account to researching and selecting stocks.

Opening a Brokerage Account

The first step in buying stocks is to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other investments. There are many brokerage firms to choose from, so it's important to do your research and find one that fits your needs.

When choosing a brokerage firm, consider factors such as fees, customer service, and the types of investments they offer. Some popular brokerage firms in the US include Charles Schwab, Fidelity, and TD Ameritrade.

Researching Stocks

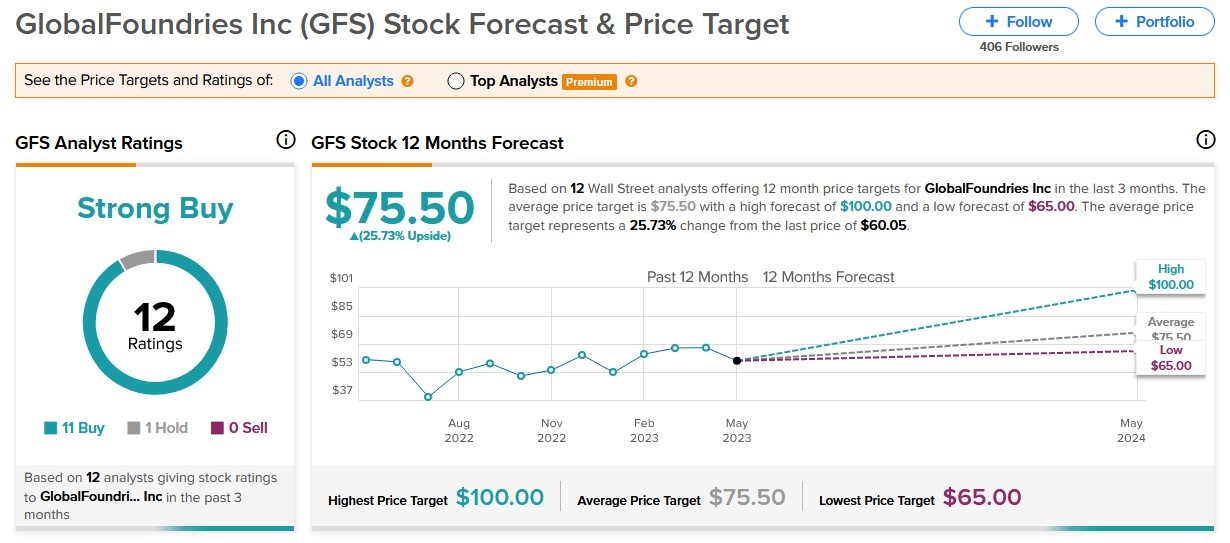

Once you have a brokerage account, the next step is to research stocks. This involves analyzing financial statements, reading news articles, and looking at stock charts. There are many resources available to help you research stocks, including financial websites, stock market apps, and investment books.

When researching stocks, pay attention to key metrics such as price-to-earnings (P/E) ratio, earnings per share (EPS), and dividend yield. These metrics can help you determine whether a stock is overvalued or undervalued.

Selecting Stocks

After you've done your research, it's time to select stocks. When choosing stocks, consider your investment goals, risk tolerance, and time horizon. For example, if you're looking for long-term growth, you might consider investing in a technology or healthcare stock. If you're looking for income, you might consider investing in a dividend-paying stock.

It's also important to diversify your portfolio by investing in different sectors and industries. This can help reduce your risk if one sector or industry performs poorly.

Buying Stocks

Once you've selected your stocks, it's time to buy them. To do this, log in to your brokerage account and enter the stock symbol and the number of shares you want to buy. You'll also need to specify whether you want to buy a market order or a limit order.

A market order is an order to buy or sell a stock at the current market price. A limit order is an order to buy or sell a stock at a specific price or better.

Monitoring Your Investments

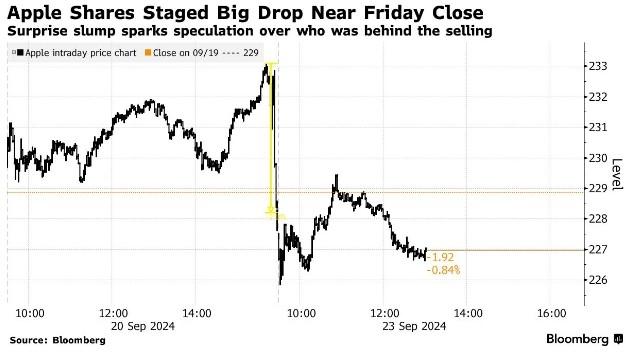

After you've bought stocks, it's important to monitor your investments. This involves regularly reviewing your portfolio and making adjustments as needed. You should also stay informed about market trends and economic news that could affect your investments.

Case Study: Apple Inc.

Let's say you're interested in investing in Apple Inc. (AAPL). After researching the company, you determine that it has a strong track record of growth and a solid dividend yield. You decide to buy 100 shares of Apple stock at $150 per share.

Over the next few years, Apple's stock price increases to

In conclusion, buying stocks in the US market can be a great way to grow your wealth over time. By following these steps and doing your research, you can make informed investment decisions and achieve your financial goals.

ZOONF Stock: Unveiling the Potential of Thi? Us stocks plummet