In today's dynamic financial market, tracking the stock price of Invesco is crucial for investors and market enthusiasts. Invesco, a leading global investment management firm, has a significant presence in the US stock market. This article delves into a comprehensive analysis of Invesco's US stock price, exploring its historical performance, current trends, and future prospects.

Historical Performance

Over the past few years, Invesco's stock price has exhibited a mix of growth and volatility. Historical data indicates that the stock has seen significant ups and downs, reflecting the broader market trends and economic conditions. For instance, during the 2020 COVID-19 pandemic, Invesco's stock price plummeted like many other stocks. However, it quickly recovered and reached new highs in the following years.

Current Trends

As of the latest data, Invesco's US stock price is showing a promising trend. The stock has been consistently rising over the past few months, driven by strong financial performance and positive market sentiment. Several factors contribute to this upward trend:

- Strong Earnings Reports: Invesco has been reporting strong earnings in recent quarters, with revenue and profit growth exceeding market expectations.

- Expansion in Product Offerings: The company has been expanding its product offerings, attracting a wider range of investors and increasing its market share.

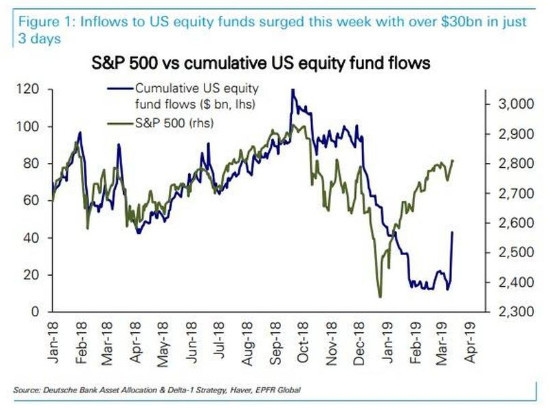

- Robust Fund Flows: Invesco has seen significant inflows into its funds, indicating strong investor confidence in its investment strategies.

Future Prospects

Looking ahead, Invesco's future prospects appear promising. Several factors support this optimistic outlook:

- Global Economic Recovery: The global economy is expected to recover gradually, leading to increased investment opportunities for Invesco.

- Growing Demand for Active Management: Active management continues to gain popularity among investors, providing a strong competitive advantage for Invesco.

- Innovative Investment Strategies: Invesco is known for its innovative investment strategies, which are well-positioned to capitalize on future market trends.

Case Studies

To illustrate the potential of Invesco's US stock, let's consider two case studies:

- Invesco's Active ETFs: Invesco's active exchange-traded funds (ETFs) have been delivering strong performance, outperforming their benchmarks. This has contributed to the company's overall growth and has attracted a significant number of investors.

- Invesco's Fixed Income Strategies: Invesco has a strong track record in fixed income strategies, particularly in emerging markets. This has helped the company maintain a diverse portfolio and attract investors seeking higher yields.

Conclusion

In summary, Invesco's US stock price has shown promising trends in recent months, driven by strong financial performance and positive market sentiment. With a robust investment strategy and a strong presence in the global market, Invesco appears well-positioned for future growth. As an investor, keeping a close eye on Invesco's US stock price can provide valuable insights into the broader market trends and potential investment opportunities.

American Battery Technology Company Common ? Us stocks plummet