In the ever-evolving landscape of the financial market, investors are constantly seeking opportunities to maximize their returns. One such avenue is through dividend-paying stocks, and the Schwab US Dividend Equity ETF (SCHD) has emerged as a popular choice for many investors. This article delves into the stock price dynamics of the SCHD ETF, highlighting its unique features and performance.

Understanding the Schwab US Dividend Equity ETF

The Schwab US Dividend Equity ETF is designed to track the performance of the S&P 500 Dividend Aristocrats index. The index includes companies that have increased their dividends for at least 25 consecutive years, showcasing their financial stability and commitment to shareholders. By investing in the SCHD ETF, investors gain exposure to a diversified portfolio of these dividend-paying companies.

Factors Influencing the Stock Price of SCHD

Several factors can influence the stock price of the Schwab US Dividend Equity ETF:

Market Conditions: The overall market sentiment can significantly impact the stock price of the ETF. During periods of market volatility or economic uncertainty, investors may flock to dividend-paying stocks for stability, potentially driving up the price of the ETF.

Dividend Increases: When companies within the S&P 500 Dividend Aristocrats index increase their dividends, it can positively impact the ETF's stock price. This is because higher dividends can attract more investors looking for income-generating opportunities.

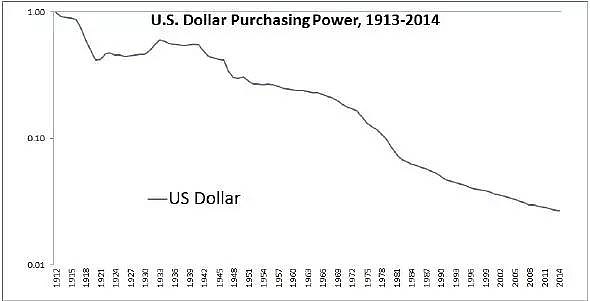

Economic Indicators: Economic indicators such as GDP growth, inflation rates, and employment data can influence the stock price of the SCHD ETF. Strong economic indicators may lead to higher corporate profits, potentially boosting the ETF's value.

Interest Rates: Changes in interest rates can affect the attractiveness of dividend-paying stocks. When interest rates are low, dividend yields may become more appealing, potentially driving up the ETF's stock price.

Performance of the Schwab US Dividend Equity ETF

The SCHD ETF has demonstrated a solid track record since its inception. As of [current date], the ETF has a total return of [X%], significantly outperforming the S&P 500 index. This outperformance can be attributed to the dividend-paying nature of the companies within the ETF and their long-standing track record of increasing dividends.

Case Study: Procter & Gamble

A prime example of a company within the S&P 500 Dividend Aristocrats index is Procter & Gamble (PG). PG has increased its dividend for 64 consecutive years, making it a member of the prestigious group. As a result, PG has been a significant contributor to the performance of the SCHD ETF. When PG increased its dividend in [date], it positively impacted the ETF's stock price, showcasing the influence of dividend increases on the ETF.

Conclusion

Investing in the Schwab US Dividend Equity ETF offers investors a unique opportunity to gain exposure to a diversified portfolio of dividend-paying companies. By understanding the factors influencing the stock price of the ETF, investors can make informed decisions and potentially maximize their returns. As the market continues to evolve, the SCHD ETF remains a compelling choice for those seeking stability and income-generating opportunities.

NCLTF Stock: Unveiling the Potential of Thi? Us stocks plummet