In the fast-paced world of stock trading, staying informed about the stock prices of major companies is crucial. One such company that has caught the attention of investors is CA Technologies, a leading provider of IT management software and solutions. In this article, we will delve into the factors that influence the CA stock price and provide you with essential insights to make informed investment decisions.

What is CA Technologies?

CA Technologies, previously known as Computer Associates International, Inc., is a global company that offers a wide range of IT management solutions. Their products help organizations manage their IT infrastructure, streamline operations, and enhance security. With a strong presence in the software industry, CA Technologies has become a key player in the market.

Factors Influencing the CA Stock Price

Several factors can influence the CA stock price. Understanding these factors is crucial for investors looking to invest in CA Technologies or any other stock. Here are some of the key factors:

1. Financial Performance

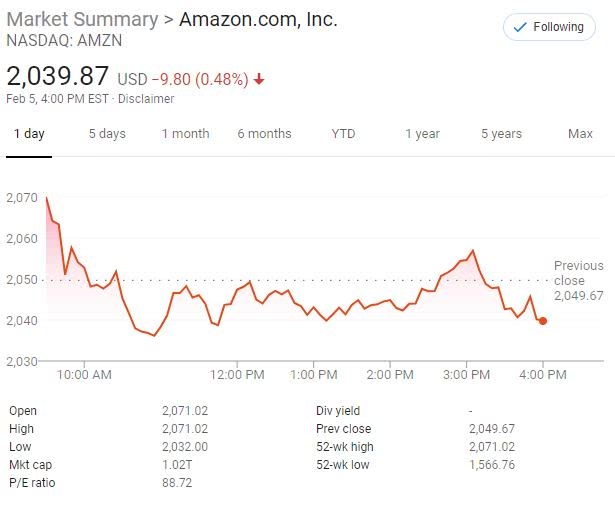

The financial performance of a company is a primary driver of its stock price. Investors closely monitor CA Technologies' revenue, earnings, and growth prospects. Positive financial results can lead to an increase in the stock price, while negative results can cause it to decline.

2. Market Trends

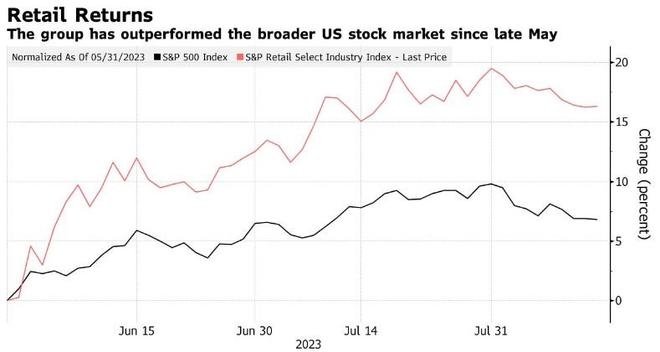

The overall market trends can also impact the CA stock price. For instance, if the technology sector is performing well, CA Technologies' stock may benefit from the positive sentiment. Conversely, if the market is facing a downturn, the stock price may be negatively affected.

3. Competition

The competitive landscape is another crucial factor. CA Technologies operates in a highly competitive market, with numerous players vying for market share. Any developments in the competitive landscape, such as new entrants or market leaders expanding their offerings, can impact the CA stock price.

4. Economic Factors

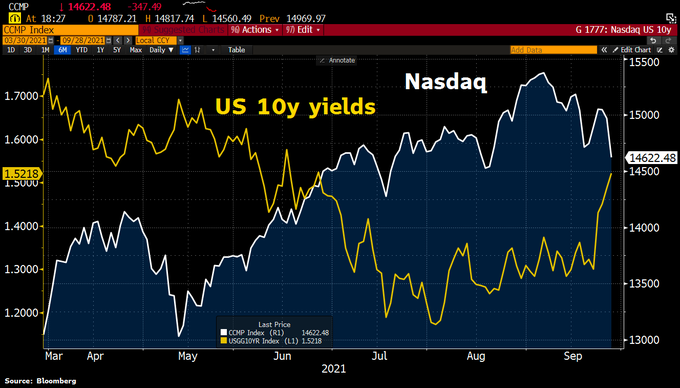

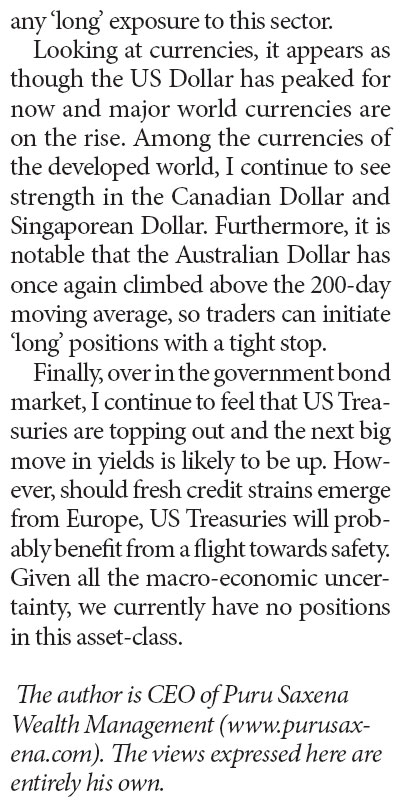

Economic factors, such as interest rates, inflation, and geopolitical events, can also influence the CA stock price. These factors can affect the overall market sentiment and, in turn, impact individual stock prices.

5. Company News and Announcements

Company-specific news and announcements can also cause significant fluctuations in the CA stock price. For instance, news about a new product launch, acquisition, or partnership can positively or negatively impact the stock price.

Case Study: CA Technologies Acquisition of Autonomy

One notable event that impacted the CA stock price was the acquisition of Autonomy Corporation PLC by CA Technologies in 2011. The acquisition was valued at approximately $10.7 billion and was aimed at expanding CA Technologies' portfolio of software solutions. However, the acquisition faced scrutiny and legal challenges, leading to a decline in the CA stock price in the short term. Over time, the stock price recovered, reflecting the long-term benefits of the acquisition.

Conclusion

Understanding the factors that influence the CA stock price is essential for investors looking to invest in CA Technologies or any other stock. By staying informed about the company's financial performance, market trends, competition, economic factors, and company news, investors can make more informed investment decisions. Remember, investing in stocks always involves risks, and it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

CRTMF Stock: The Ultimate Guide to Understa? Us stocks plummet