The US stock market, often regarded as a barometer of the global economic landscape, has been experiencing a mix of growth and uncertainty in recent times. As we delve into the current trends and factors influencing the market, it becomes evident that several key aspects are driving its performance.

Rising Corporate Profits

One of the primary factors contributing to the US stock market's current strength is the surge in corporate profits. Companies across various sectors, from technology to healthcare, have reported significant increases in earnings, fueled by strong demand and cost-cutting measures. This positive trend has bolstered investor confidence and led to increased stock prices.

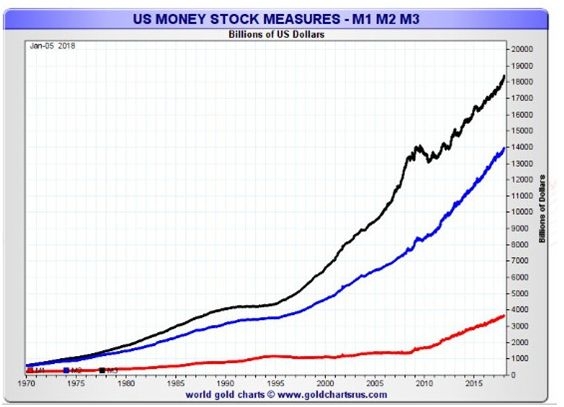

Low Interest Rates

The Federal Reserve's decision to keep interest rates low has been another crucial factor in the stock market's resilience. Low interest rates make borrowing cheaper for businesses and individuals, which in turn boosts economic activity and corporate profitability. This has provided a supportive environment for stocks, as investors seek higher returns compared to traditional savings accounts or bonds.

Tech Stocks Leading the Charge

Technology stocks have been a significant driver of the US stock market's recent performance. Companies like Apple, Amazon, and Microsoft have seen their share prices soar, propelled by strong revenue growth and innovative products. This trend has been particularly pronounced during the pandemic, as technology companies have thrived in the face of remote work and online shopping trends.

Inflation Concerns and Stock Market Reactions

Despite the market's strong performance, investors are keeping a close eye on inflation concerns. As the economy recovers from the pandemic, there is a growing concern about rising inflationary pressures. However, the stock market has largely remained resilient, as investors believe that inflation will be transient and that the Federal Reserve will take appropriate measures to control it.

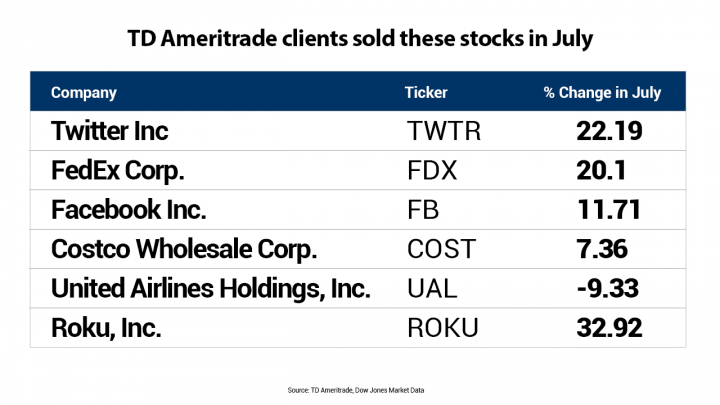

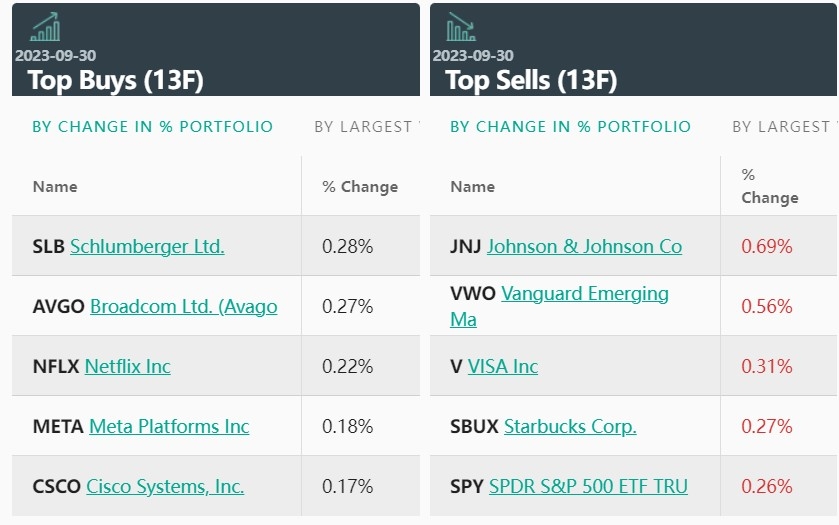

Diversification and Risk Management

Another factor contributing to the stock market's stability is the increasing focus on diversification and risk management. Investors are seeking out a wide range of investments across different sectors and geographies to mitigate risks. This has led to a more balanced market and reduced volatility.

Case Studies: Apple and Tesla

Let's take a closer look at two companies that exemplify the current trends in the US stock market. Apple, a leader in the technology sector, has seen its share price surge in recent years, driven by its innovative products and strong financial performance. On the other hand, Tesla, another tech giant, has also experienced significant growth, as it has become a leader in the electric vehicle market.

In conclusion, the US stock market is currently performing well, driven by factors such as rising corporate profits, low interest rates, and strong technology sector performance. While there are concerns about inflation and other economic uncertainties, investors remain optimistic about the market's long-term prospects. As always, it's important for investors to stay informed and diversify their portfolios to manage risks effectively.

HCGOF Stock: The Ultimate Guide to Understa? Us stocks plummet