Understanding the Investment Strategy of the Swiss National Bank

The Swiss National Bank (SNB) has long been a topic of interest among investors and financial analysts worldwide. One of the most debated questions is whether the SNB is buying US stocks. This article delves into the investment strategy of the SNB and explores the possibility of its involvement in the US stock market.

The Investment Strategy of the Swiss National Bank

The SNB is known for its unconventional monetary policy, which includes buying foreign currencies to weaken the Swiss franc. This policy has been in place for several years to prevent deflation and stimulate the Swiss economy. As part of its investment strategy, the SNB has been purchasing a wide range of assets, including foreign government bonds, corporate bonds, and equities.

Is the Swiss National Bank Buying US Stocks?

While there is no official confirmation from the SNB regarding its investment in US stocks, several reports and analyses suggest that it may indeed be doing so. The following points provide evidence to support this theory:

Currency Hedging: The SNB has been known to engage in currency hedging to protect its investments from fluctuations in the Swiss franc. By investing in US stocks, the SNB can hedge against the franc's volatility and potentially earn higher returns.

Diversification: Diversification is a key aspect of the SNB's investment strategy. By investing in US stocks, the SNB can diversify its portfolio and reduce exposure to risks associated with the Swiss economy.

Historical Data: Historical data indicates that the SNB has invested in US assets in the past. For instance, in 2011, the SNB bought a significant amount of US Treasuries to diversify its portfolio.

Economic Conditions: The SNB's decision to invest in US stocks could be influenced by favorable economic conditions in the United States. The US economy has been performing well, with low unemployment rates and strong GDP growth.

Case Study: SNB's Investment in US Bonds

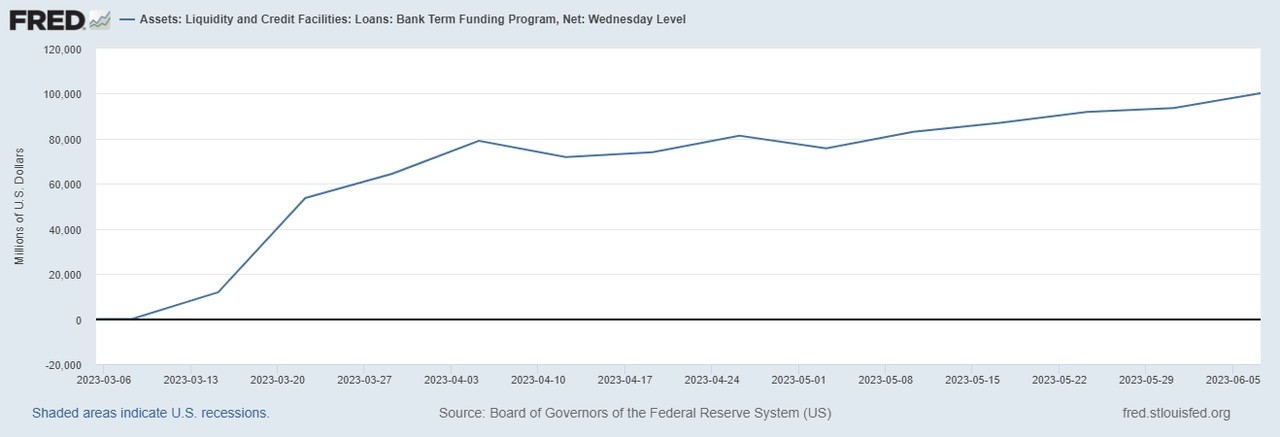

To further understand the SNB's investment strategy, let's take a look at its investment in US bonds. In 2011, the SNB invested approximately $80 billion in US Treasuries. This move was aimed at diversifying its portfolio and reducing exposure to the Swiss franc.

The investment in US bonds proved to be a successful strategy for the SNB. The Swiss franc weakened as a result of the SNB's monetary policy, and the SNB's investments in US bonds generated significant returns.

Conclusion

While there is no concrete evidence to confirm that the Swiss National Bank is buying US stocks, several factors suggest that it may be doing so. The SNB's unconventional monetary policy, investment strategy, and historical data indicate that investing in US stocks could be a part of its portfolio diversification efforts.

Investors and financial analysts should continue to monitor the SNB's investment decisions to better understand its strategy and potential impact on the global financial markets.

KYOWF Stock: Unveiling the Potential of Thi? America stock market