Are you looking to transfer your US stocks to Canada? If so, you're not alone. Many investors are exploring cross-border investment opportunities to diversify their portfolios and take advantage of different market conditions. This guide will provide you with everything you need to know about transferring your US stocks to Canada, including the process, potential tax implications, and important considerations.

Understanding the Process

Transferring US stocks to Canada involves several steps. The first step is to choose a brokerage firm that offers cross-border trading services. There are several reputable brokerage firms in Canada that can help you with this process, including TD Ameritrade, Questrade, and Interactive Brokers.

Once you have chosen a brokerage firm, you will need to open an account with them. This process typically involves providing identification documents, proof of address, and information about your financial situation. Once your account is open, you can transfer your US stocks to Canada.

Transferring Your US Stocks

To transfer your US stocks to Canada, you will need to provide your brokerage firm with the following information:

- Your account number with the US brokerage firm

- The name of the US brokerage firm

- The ticker symbols of the US stocks you want to transfer

Your brokerage firm will then initiate the transfer process on your behalf. The transfer process typically takes a few days to complete, but it can vary depending on the brokerage firm and the complexity of your portfolio.

Potential Tax Implications

When transferring US stocks to Canada, it's important to consider the potential tax implications. Here are some key points to keep in mind:

- Capital Gains Tax: If you have a capital gain on the US stocks you're transferring, you may be subject to capital gains tax in Canada. The rate of tax will depend on the type of investment and your income level.

- Withholding Tax: US stocks may be subject to withholding tax if they are sold within a certain period after transfer. This tax is typically withheld at a rate of 30%.

- Tax Reporting: You will need to report the transfer of your US stocks on your Canadian tax return.

Important Considerations

Before transferring your US stocks to Canada, there are several important considerations to keep in mind:

- Investment Strategy: Make sure that transferring your US stocks aligns with your overall investment strategy and financial goals.

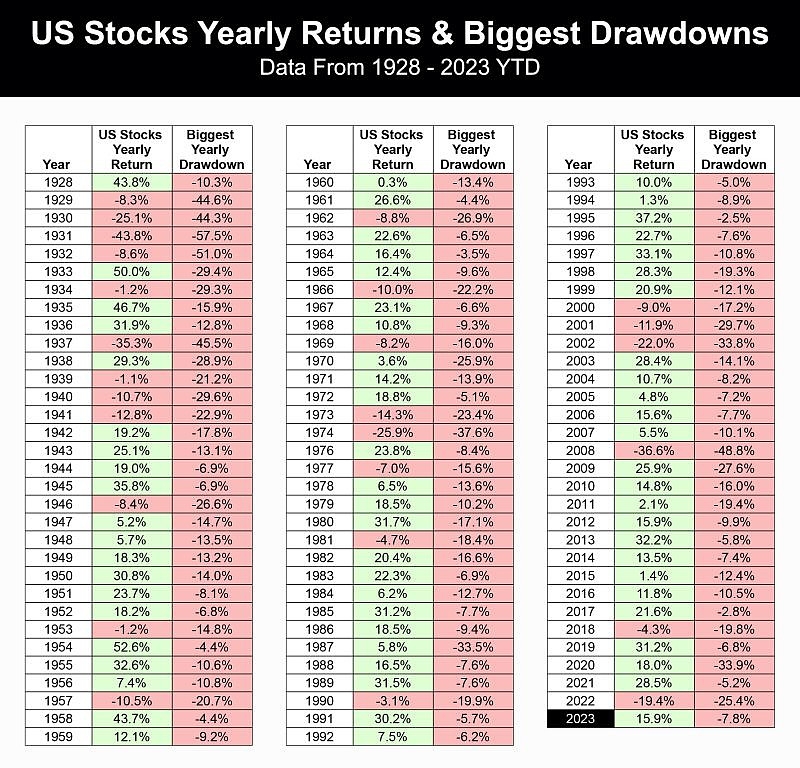

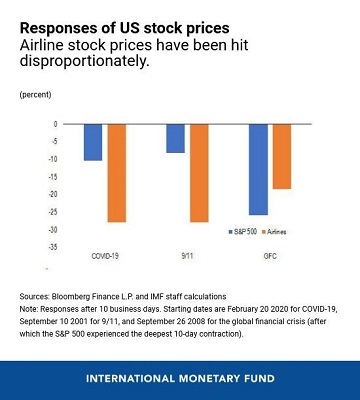

- Market Conditions: Consider the current market conditions in both the US and Canada before making a decision.

- Fees and Costs: Be aware of any fees or costs associated with transferring your US stocks to Canada, including brokerage fees, transfer fees, and potential tax liabilities.

Case Study: John’s US Stock Transfer to Canada

John, a long-time investor, decided to transfer his US stocks to Canada to diversify his portfolio and take advantage of the strong performance of the Canadian market. After researching different brokerage firms, he chose TD Ameritrade for its comprehensive cross-border trading services.

John opened an account with TD Ameritrade and transferred his US stocks to Canada. He worked closely with a financial advisor to ensure that the transfer aligned with his investment strategy and minimize any potential tax liabilities.

Conclusion

Transferring your US stocks to Canada can be a smart move for investors looking to diversify their portfolios and take advantage of different market conditions. By understanding the process, potential tax implications, and important considerations, you can make an informed decision that aligns with your financial goals.

Buying US Stock on Wealthsimple: A Comprehe? Us stock news