The United States is home to the world's largest and most diverse stock market. With thousands of publicly traded companies, investors have a wide range of options to choose from. But just how many public stocks are there in the US? In this article, we'll explore the number of public stocks in the US, their significance, and the factors that influence this number.

Understanding Public Stocks

A public stock is a share of a company that is traded on a stock exchange. When a company decides to go public, it issues shares to the public, allowing investors to buy and sell these shares on the stock market. The primary purpose of going public is to raise capital, expand operations, and provide liquidity to shareholders.

The Number of Public Stocks in the US

As of 2021, there are approximately 3,800 publicly traded companies in the US. This number has fluctuated over the years due to various factors, including market conditions, regulatory changes, and company performance.

Significance of Public Stocks

The number of public stocks in the US is significant for several reasons:

Investment Opportunities: A diverse range of public stocks provides investors with a wide array of investment opportunities. This diversity allows investors to allocate their capital across different sectors, industries, and geographic regions.

Economic Growth: Public companies contribute significantly to the US economy. They create jobs, generate revenue, and drive innovation. The presence of a large number of public stocks reflects the strength and resilience of the US economy.

Market Liquidity: A large number of public stocks ensures high market liquidity. This means that investors can easily buy and sell shares without significantly impacting the stock price.

Factors Influencing the Number of Public Stocks

Several factors influence the number of public stocks in the US:

Regulatory Changes: Changes in securities regulations can impact the number of companies going public. For example, the JOBS Act of 2012 made it easier for small and mid-sized companies to go public.

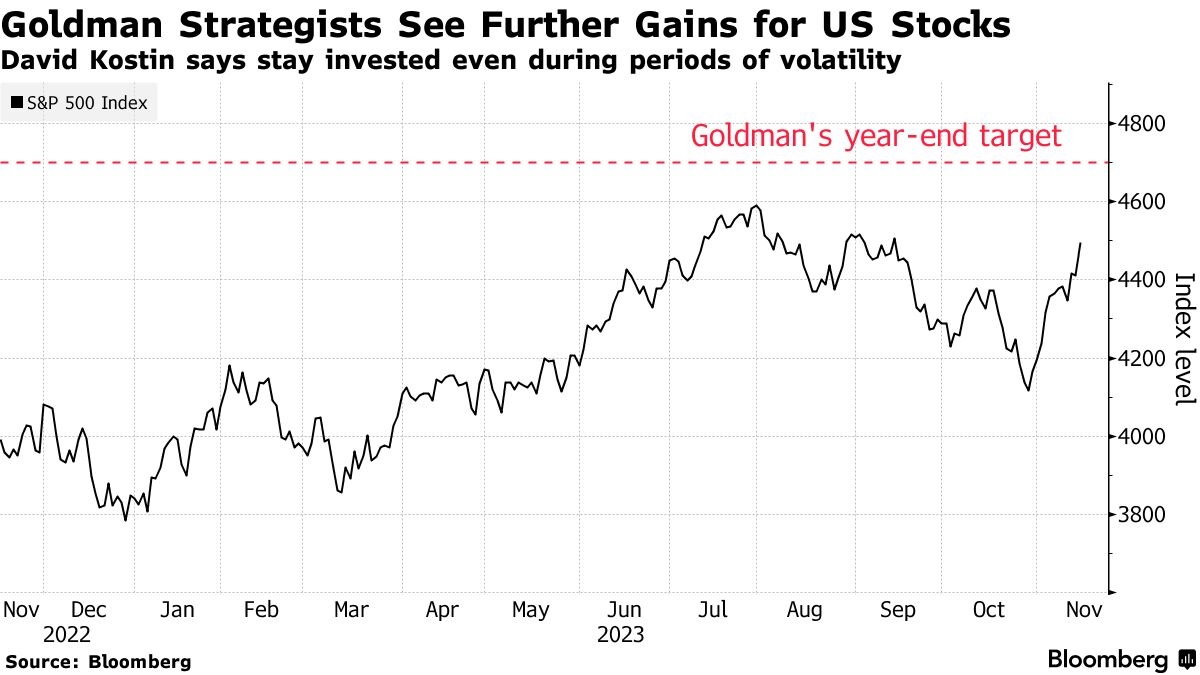

Market Conditions: Economic conditions, such as recessions or bull markets, can influence the number of companies going public. During economic downturns, fewer companies may choose to go public, while during bull markets, more companies may seek to capitalize on high valuations.

Company Performance: The performance of individual companies can also impact the number of public stocks. Companies that perform well may attract more investors, leading to an increase in the number of public stocks.

Case Studies

To illustrate the impact of public stocks, let's consider a few case studies:

Facebook (FB): Facebook went public in 2012, raising $16 billion. This initial public offering (IPO) was one of the largest in history and significantly increased the number of public stocks in the US.

Tesla (TSLA): Tesla's IPO in 2010 was another significant event. The company raised $17 billion, and its stock has since become one of the most popular among investors.

Pinterest (PINS): Pinterest's IPO in 2019 was a notable event for the tech industry. The company raised $1.4 billion and became the first tech IPO since 2014.

In conclusion, the number of public stocks in the US is a reflection of the country's economic strength and diversity. With thousands of publicly traded companies, investors have a wide range of options to choose from. As the market continues to evolve, we can expect the number of public stocks to fluctuate, driven by various factors such as regulatory changes, market conditions, and company performance.

Lemonade Stock: The Refreshing Beverage Tha? Us stock information