Investing in the stock market is a high-stakes game that often leaves investors on the edge of their seats, wondering if they should pull the trigger or wait for a better opportunity. The question, "Will the market be up tomorrow?" is a common concern among both seasoned investors and newcomers alike. In this article, we'll explore the factors that could influence market trends, provide a glimpse into the crystal ball, and help you make a more informed decision.

Understanding Market Trends

The stock market's performance is influenced by a myriad of factors, including economic indicators, political events, corporate earnings reports, and global market trends. To predict the market's direction for the next day, it's essential to consider these elements:

- Economic Indicators: Key economic reports, such as GDP growth, unemployment rates, and inflation, can significantly impact the market. A strong economy may lead to a higher market, while a weak economy could drive it down.

- Political Events: Political instability or significant events, such as elections or trade agreements, can create uncertainty in the market. This uncertainty often leads to volatility.

- Corporate Earnings Reports: When companies report their earnings, the market's reaction can be dramatic. Strong earnings reports can push the market up, while weak reports can drag it down.

- Global Market Trends: The stock market is interconnected with global markets, so trends in other countries can influence the U.S. market as well.

Using Historical Data to Predict the Market

While it's impossible to predict the future with absolute certainty, historical data can provide some insight. Traders often use various technical indicators and historical patterns to make predictions. Here are a few methods to consider:

- Moving Averages: Moving averages (MAs) are a popular technical indicator used to analyze market trends. They smooth out price data over a specific period, helping to identify the market's direction.

- Bollinger Bands: Bollinger Bands consist of a middle band being an MA, with upper and lower bands providing price levels. These bands can help identify potential overbought or oversold conditions in the market.

- Volume: Analyzing trading volume can provide insights into the market's strength. An increase in volume often indicates strong market movement.

Case Studies

To illustrate the importance of considering various factors when predicting market trends, let's look at a few case studies:

- 2020 Stock Market Crash: The COVID-19 pandemic led to a sharp drop in the stock market. Investors who considered economic indicators and global market trends were able to predict the downward trend and adjust their portfolios accordingly.

- 2019 U.S. Stock Market Rally: The U.S. stock market experienced a strong rally in 2019. Investors who analyzed corporate earnings reports and economic indicators were able to capitalize on this upward trend.

Final Thoughts

Predicting the stock market's direction for the next day is a challenging task, but by considering economic indicators, political events, corporate earnings reports, and historical data, you can make a more informed decision. Remember that investing in the stock market involves risk, and it's essential to do your homework and stay informed before making any investment decisions.

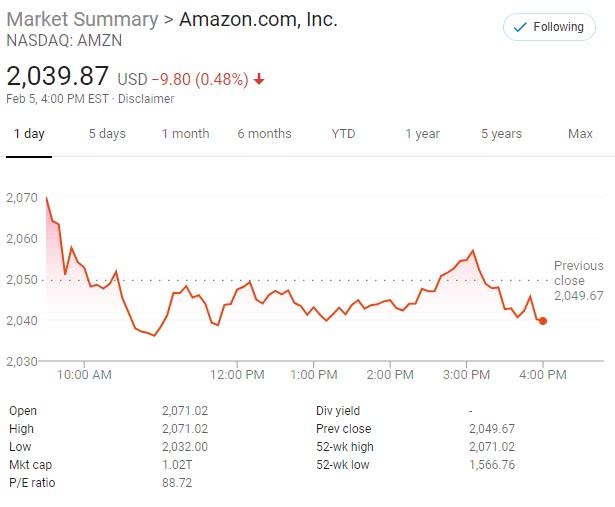

Artius II Acquisition Inc. Class A Ordinary? Us stock information