Are you an investor in India looking to diversify your portfolio with US stocks? If so, you've come to the right place. This article will guide you through the process of purchasing US stocks from India, highlighting the benefits, the steps involved, and the considerations you need to keep in mind.

Understanding the Process

Before diving into the details, it's important to understand that buying US stocks from India involves a few steps. Firstly, you'll need to open a brokerage account with a US-based brokerage firm. This will allow you to access the US stock market and purchase stocks. Once your account is set up, you can transfer funds from your Indian bank account to your brokerage account.

Benefits of Buying US Stocks from India

Diversification: By investing in US stocks, you can diversify your portfolio and reduce your exposure to the Indian stock market. This is particularly beneficial during volatile market conditions.

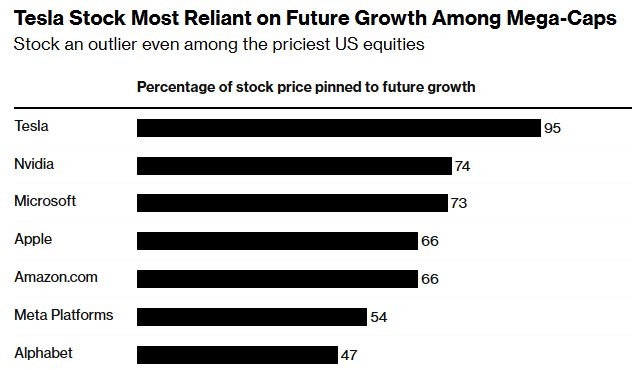

Access to Top Companies: The US stock market is home to some of the world's largest and most successful companies, including tech giants like Apple, Google, and Microsoft. By investing in these companies, you can gain exposure to some of the fastest-growing industries in the world.

Currency Conversion: Investing in US stocks can also be a way to diversify your currency exposure. If the Indian rupee strengthens against the US dollar, your investments in US stocks will become more valuable in rupee terms.

Steps to Buy US Stocks from India

Choose a US Brokerage Firm: Research and choose a reputable US brokerage firm that offers services to international investors. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

Open a Brokerage Account: Visit the chosen brokerage firm's website and fill out the required application form. You will need to provide personal information, proof of identity, and address verification documents.

Fund Your Account: Transfer funds from your Indian bank account to your new brokerage account. You can do this through wire transfer or an electronic funds transfer (EFT).

Research and Invest: Once your account is funded, you can start researching and selecting stocks to invest in. Use the brokerage firm's platform to place your orders.

Considerations

Transaction Costs: Be aware of the transaction costs involved in buying US stocks. These may include brokerage fees, wire transfer fees, and currency conversion fees.

Tax Implications: Ensure you understand the tax implications of investing in US stocks from India. You may need to file a tax return in India and pay taxes on any gains made from your US stock investments.

Regulatory Compliance: Make sure you comply with all regulatory requirements for international investors. This may include reporting requirements and the need for a tax identification number (TIN).

Case Study: Investing in Apple from India

Consider the case of Rajesh, an Indian investor who wanted to diversify his portfolio. He decided to invest in Apple, one of the world's most valuable companies. By following the steps outlined above, Rajesh opened an account with a US brokerage firm, funded his account, and purchased shares of Apple. Over time, his investment in Apple grew significantly, and he reaped the benefits of diversifying his portfolio.

In conclusion, buying US stocks from India is a viable option for investors looking to diversify their portfolios and gain exposure to the world's largest companies. By following the steps outlined in this article and considering the associated factors, you can successfully invest in US stocks from India.

Applied Optoelectronics Inc. Common Stock: ? Us stocks plummet