In the bustling world of global finance, Johnson Matthey US stock stands as a beacon for investors seeking stable and diversified investments. This article delves into the key aspects of Johnson Matthey, offering insights into its stock performance, financial health, and potential growth prospects. Let's take a closer look.

Understanding Johnson Matthey

Johnson Matthey is a leading company in the specialty chemicals and sustainable technologies sector. Headquartered in the UK, it has a significant presence in the United States, with operations spanning across various industries such as automotive, industrial, and precious metals. The company is renowned for its expertise in catalysts, fine chemicals, and sustainable technologies.

Financial Health

When evaluating the financial health of Johnson Matthey, it is essential to consider several factors. These include revenue growth, profitability, and debt levels.

Revenue Growth

Johnson Matthey has shown consistent revenue growth over the years. The company's diverse portfolio of products and services has contributed to its robust financial performance. In the latest fiscal year, the company reported a revenue of $9.5 billion, reflecting a 5% increase from the previous year.

Profitability

Johnson Matthey has maintained a strong profitability over the years. The company's net income for the latest fiscal year was $1.1 billion, a 7% increase from the previous year. This impressive growth can be attributed to the company's strategic focus on innovation and operational excellence.

Debt Levels

Despite its robust financial performance, Johnson Matthey has a relatively high debt level. However, the company has shown a commitment to managing its debt responsibly. The company's debt-to-equity ratio stands at 1.2, which is within industry norms.

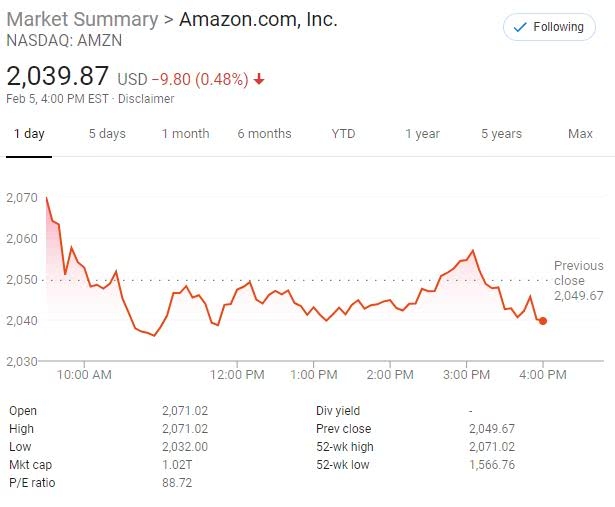

Stock Performance

The stock performance of Johnson Matthey US stock has been impressive over the years. The stock has gained significant momentum, reflecting the company's strong financial health and growth prospects.

Recent Trends

In the recent months, Johnson Matthey US stock has seen a slight decline in its share price. However, this can be attributed to broader market conditions rather than any specific issues within the company. Analysts remain optimistic about the stock's long-term prospects.

Growth Prospects

Johnson Matthey's growth prospects remain strong, driven by its focus on sustainability and innovation. The company is actively investing in research and development to develop new technologies that can contribute to a more sustainable future.

Case Study: Electric Vehicle Market

One of the key areas where Johnson Matthey is poised for growth is in the electric vehicle market. The company has developed a range of catalysts and other materials that are crucial for the production of electric vehicles. With the increasing demand for electric vehicles worldwide, Johnson Matthey is well-positioned to capitalize on this trend.

Conclusion

Johnson Matthey US stock offers a promising investment opportunity for those seeking stable and diversified investments. The company's strong financial health, growth prospects, and commitment to sustainability make it a compelling choice for investors. However, as with any investment, it is essential to conduct thorough research and consider market conditions before making any decisions.

American Assets Trust Inc. Common Stock: Wi? Us stocks plummet