Are you considering investing in the stock market but unsure about which market to choose? The Australian Stock Exchange (ASX) and the US stock market are two of the most popular markets for investors worldwide. In this article, we will delve into a comprehensive comparison of ASX vs. US stocks to help you make an informed decision.

Understanding the ASX

The Australian Stock Exchange, often abbreviated as ASX, is the primary stock exchange in Australia. It was established in 1987 and is one of the oldest stock exchanges in the world. The ASX has a diverse range of companies listed, including large multinational corporations, small-cap stocks, and everything in between.

Understanding the US Stock Market

The US stock market is the largest and most influential stock market in the world. It includes several exchanges, the most notable being the New York Stock Exchange (NYSE) and the NASDAQ. The US stock market is home to some of the world's largest and most successful companies, such as Apple, Microsoft, and Google.

Market Size and Liquidity

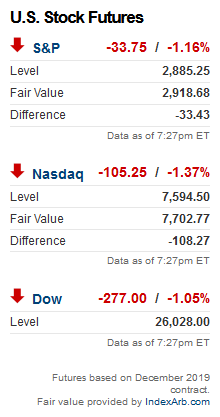

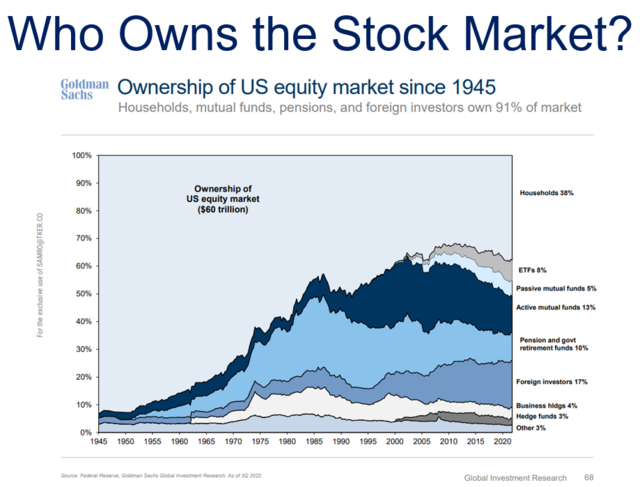

One of the most significant differences between the ASX and the US stock market is the market size and liquidity. The US stock market is significantly larger than the ASX, with a market capitalization of over $30 trillion. This large market size provides investors with a wide range of investment opportunities, including access to emerging markets and international stocks.

Liquidity, on the other hand, refers to how quickly and easily a security can be bought or sold without affecting its price. The US stock market generally offers higher liquidity compared to the ASX, which can be beneficial for investors looking to trade frequently or execute large orders.

Sector Diversification

The sectors represented in the ASX and the US stock market also differ. The ASX has a strong focus on mining and resources, while the US stock market has a broader range of sectors, including technology, healthcare, and consumer goods.

Dividends and Yield

Dividends and yield are crucial factors for many investors. The ASX offers a higher dividend yield compared to the US stock market. This can be attractive for income investors looking for regular income streams.

Risk and Return

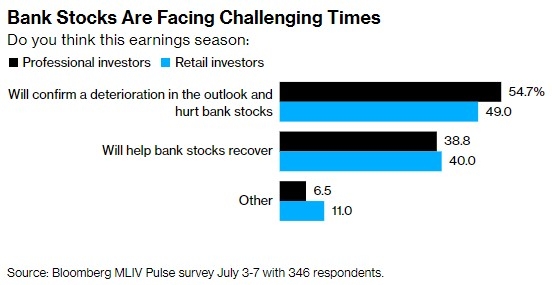

The ASX and the US stock market both offer potential for high returns, but they also come with their respective risks. The ASX is generally considered to be less volatile compared to the US stock market, making it a more stable investment option for conservative investors. However, the US stock market offers higher growth potential, especially in sectors such as technology.

Conclusion

Choosing between the ASX and the US stock market depends on your investment goals, risk tolerance, and market preferences. Both markets offer unique advantages and disadvantages, and it's important to conduct thorough research before making a decision. Whether you're an experienced investor or just starting out, understanding the differences between these two markets can help you make a more informed investment decision.

For instance, if you're seeking stable income and lower risk, the ASX might be the better choice. On the other hand, if you're looking for high growth potential and a wide range of investment opportunities, the US stock market could be more suitable.

Remember, investing in the stock market requires careful planning and research. Always consult with a financial advisor before making any investment decisions.

AllianceBernstein Holding L.P. Units Extend? Us stocks plummet