In a world increasingly focused on sustainable energy solutions, nuclear power plant stocks have become a significant investment opportunity in the United States. With the rising demand for clean energy and the declining cost of nuclear technology, these stocks are poised to become a crucial component of the nation's energy landscape. This article delves into the potential of nuclear power plant stocks in the US, highlighting their role in the energy sector and providing insights into their investment potential.

The Rise of Nuclear Power Plant Stocks

The United States has long been a leader in nuclear energy, with over 100 nuclear power plants currently in operation. These plants generate approximately 20% of the country's electricity, making them a vital part of the nation's energy mix. As the world moves towards cleaner energy sources, nuclear power plant stocks have gained significant attention from investors.

Clean Energy Demand

The increasing demand for clean energy is a major driving force behind the growth of nuclear power plant stocks. With the Paris Agreement and various state-level initiatives aimed at reducing carbon emissions, the US government and private companies are investing heavily in clean energy technologies. Nuclear power, being a low-carbon energy source, is at the forefront of this movement.

Declining Costs of Nuclear Technology

One of the most significant developments in the nuclear power industry is the declining cost of nuclear technology. Advances in design, construction, and maintenance have made nuclear power plants more efficient and cost-effective. This has led to a surge in investment in nuclear power plant stocks, as companies see the potential for significant returns on their investments.

Investment Opportunities in Nuclear Power Plant Stocks

Several companies in the US are involved in the nuclear power industry, offering a wide range of investment opportunities. Some of the key players include:

Exelon Corporation: One of the largest nuclear energy companies in the US, Exelon Corporation operates over 20 nuclear power plants across the country. The company's focus on clean energy and its commitment to sustainability make it an attractive investment option.

Entergy Corporation: Entergy Corporation is another major player in the nuclear power industry, with a diverse portfolio of energy assets, including nuclear power plants. The company's focus on innovation and its commitment to reducing carbon emissions make it a compelling investment opportunity.

Nuclear Energy Institute (NEI): While not a company, the NEI is an important organization in the nuclear power industry. It provides valuable insights into the industry's trends and developments, making it a useful resource for investors.

Case Study: Westinghouse Electric Company

One notable case study in the nuclear power plant stocks sector is Westinghouse Electric Company. Once a leading nuclear technology provider, Westinghouse filed for bankruptcy in 2017 due to financial struggles. However, the company's assets were acquired by Toshiba Corporation, and it has since been restructured and is now back in business. This case highlights the potential for growth and recovery in the nuclear power industry, making investments in nuclear power plant stocks an exciting opportunity.

Conclusion

In conclusion, nuclear power plant stocks represent a promising investment opportunity in the US energy sector. With the increasing demand for clean energy and the declining cost of nuclear technology, these stocks are poised to become a crucial component of the nation's energy landscape. As investors continue to seek sustainable and efficient energy solutions, nuclear power plant stocks will likely remain a key area of focus.

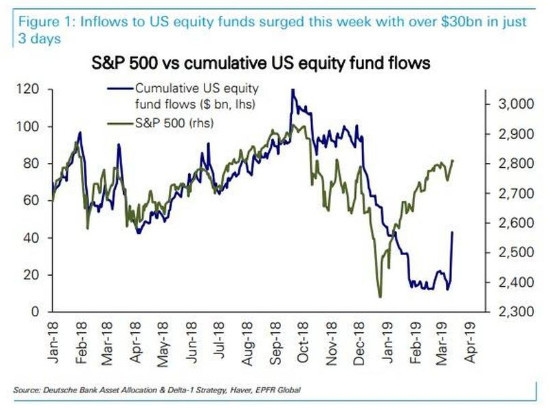

Atlantic American Corporation Common Stock:? Us stocks plummet