The recent bounce in the US stock market has been nothing short of remarkable. After a tumultuous period marked by volatility and uncertainty, investors are witnessing a strong recovery. This article delves into the factors contributing to this bounce, the resilience of the market, and the insights it provides for investors.

Market Resilience

The US stock market has shown an incredible ability to bounce back from adversity. This resilience can be attributed to several factors. First and foremost, the Federal Reserve's (Fed) accommodative monetary policy has provided a strong support system. By keeping interest rates low and implementing quantitative easing, the Fed has helped to stabilize the market.

Inflation and Interest Rates

The recent bounce in the stock market has been closely tied to the inflation and interest rates landscape. Despite the Federal Reserve's efforts to control inflation, it has struggled to keep it at its 2% target. However, the market has responded positively to the Fed's commitment to control inflation without causing significant economic damage.

Sector Performance

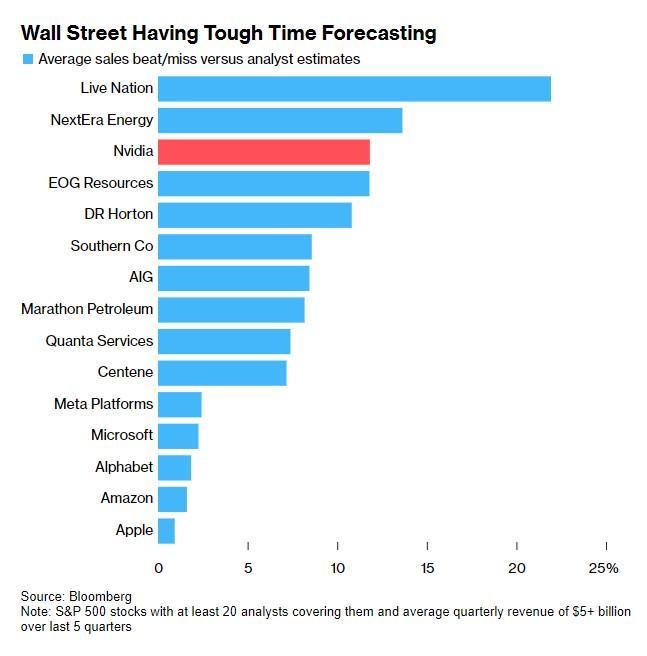

Certain sectors have been the standout performers in the recent bounce. Technology stocks, particularly those in the cloud computing and artificial intelligence space, have seen significant gains. This can be attributed to the growing demand for digital transformation and remote work, which has accelerated due to the pandemic.

Economic Recovery

The bounce in the stock market is also a reflection of the broader economic recovery. As vaccination rates rise and economies reopen, consumer spending is picking up. This, in turn, has led to increased corporate earnings and a positive outlook for the stock market.

Case Study: Tesla

One notable example of a stock that has soared during the bounce is Tesla. The electric vehicle manufacturer has seen its share price skyrocket in recent months. This can be attributed to its strong financial performance, innovative products, and leadership in the electric vehicle market.

Investor Insights

The recent bounce in the US stock market provides several insights for investors. Firstly, it highlights the importance of diversification. Investing in a wide range of sectors and asset classes can help to mitigate risk and capitalize on various market conditions.

Secondly, it underscores the value of patience and long-term investing. The stock market can be unpredictable in the short term, but over the long term, it has historically provided strong returns.

Finally, it emphasizes the importance of staying informed and adapting to changing market conditions. The recent bounce has shown that even in times of uncertainty, opportunities for growth and profitability exist.

In conclusion, the recent bounce in the US stock market is a testament to its resilience and the economic recovery. By understanding the factors contributing to this bounce and applying these insights, investors can navigate the market with greater confidence and success.

Ambev S.A. American Depositary Shares (Each? Us stocks plummet