Investing in US stocks from Malaysia can be a lucrative opportunity for investors looking to diversify their portfolio and tap into the world's largest and most diverse stock market. With the rise of online trading platforms and the globalization of financial markets, buying US stocks from Malaysia has become more accessible than ever before. This article will provide a comprehensive guide on how to buy US stocks in Malaysia, including the necessary steps, considerations, and potential benefits.

Understanding the Process

Open a Brokerage Account: The first step in buying US stocks from Malaysia is to open a brokerage account with a reputable online broker. Many brokers offer services that allow you to trade US stocks from Malaysia, including TD Ameritrade, E*TRADE, and Charles Schwab.

Research and Select Stocks: Once you have your brokerage account, it's time to research and select the stocks you want to invest in. Consider factors such as the company's financial health, industry trends, and market conditions. You can use financial websites, stock market apps, and investment forums to gather information and make informed decisions.

Fund Your Account: Before you can start buying stocks, you need to fund your brokerage account. You can transfer funds from your Malaysian bank account or use a credit card to deposit money into your account.

Place Your Order: Once your account is funded, you can place your order to buy US stocks. Most brokers offer a variety of order types, including market orders, limit orders, and stop orders. Choose the order type that best suits your investment strategy.

Considerations for Buying US Stocks in Malaysia

Currency Conversion: When buying US stocks from Malaysia, you'll need to consider currency conversion fees. Most brokers charge a fee for converting your Malaysian ringgit to US dollars. It's important to compare fees and choose a broker with competitive rates.

Tax Implications: While you won't pay taxes on capital gains from US stocks in Malaysia, you may need to report your investments to the Malaysian Inland Revenue Board (IRB). It's important to consult with a tax professional to ensure compliance with tax regulations.

Regulatory Compliance: Make sure your brokerage firm is registered with the Securities Commission Malaysia (SC) and adheres to the country's regulatory requirements. This will help protect your investments and ensure a smooth trading experience.

Benefits of Buying US Stocks in Malaysia

Diversification: Investing in US stocks can help diversify your portfolio and reduce risk. The US stock market is home to many large, well-established companies across various industries, making it an attractive option for investors looking to diversify their investments.

Potential for High Returns: The US stock market has historically offered higher returns than many other markets. By investing in US stocks, you can potentially earn higher returns on your investments.

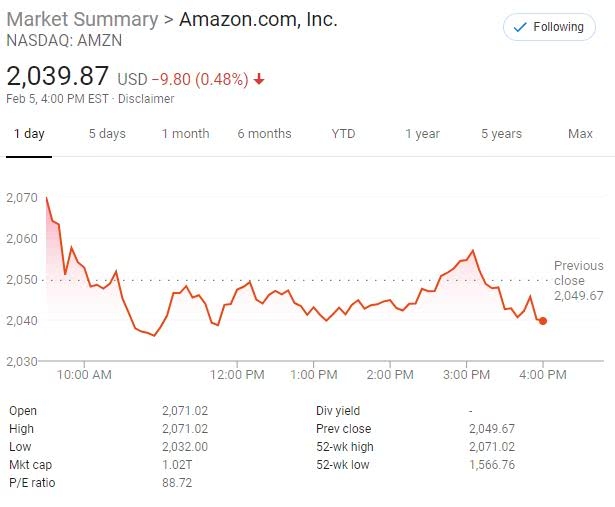

Access to World-Class Companies: The US stock market is home to some of the world's most successful and innovative companies, including Apple, Microsoft, and Amazon. By investing in these companies, you can gain exposure to their growth and success.

Case Study: Investing in Apple from Malaysia

Consider an investor in Malaysia who decides to invest in Apple Inc. (AAPL) using a US brokerage account. The investor funds their account with

This case study demonstrates the potential for high returns when investing in US stocks from Malaysia. By following the steps outlined in this article, investors can take advantage of the opportunities available in the US stock market.

Buying US stocks from Malaysia can be a rewarding investment strategy. By understanding the process, considering the necessary steps, and being aware of the potential benefits and risks, investors can make informed decisions and achieve their financial goals.

Atlantic American Corporation Common Stock:? Us stocks plummet