In the bustling world of energy and finance, the largest US oil refiner stocks hold a significant position. These companies play a crucial role in processing crude oil into various refined products, including gasoline, diesel, and jet fuel. This article delves into the top US oil refiner stocks, their market performance, and factors influencing their stock prices.

Top US Oil Refiner Stocks

Exxon Mobil Corporation (XOM) Exxon Mobil, often referred to as "Exxon," is one of the largest publicly traded oil and gas companies in the world. Its stock has consistently been a top performer in the industry, thanks to its vast reserves and diversified operations.

Chevron Corporation (CVX) Chevron is another leading player in the oil refining sector. The company's stock has seen steady growth over the years, driven by its extensive global operations and commitment to sustainable energy practices.

Valero Energy Corporation (VLO) Valero Energy is one of the largest independent oil refiners in the United States. Its stock has been a popular choice among investors due to its strong financial performance and strategic focus on cost efficiency.

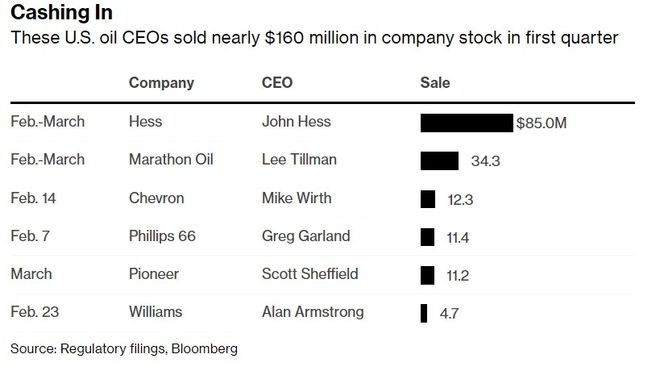

Marathon Petroleum Corporation (MPC) Marathon Petroleum is a leading oil refiner and marketer in the United States. Its stock has seen significant growth, driven by its robust refining operations and strategic investments in the midstream sector.

Phillips 66 (PSX) Phillips 66 is a diversified energy company that operates in the downstream sector of the oil and gas industry. Its stock has been a favorite among investors due to its strong operational performance and commitment to innovation.

Factors Influencing Stock Prices

The stock prices of US oil refiner stocks are influenced by several factors:

Crude Oil Prices: The price of crude oil is a primary driver of oil refiner stock prices. Higher crude oil prices can lead to increased profits for refiners, while lower prices can have the opposite effect.

Refining Margins: Refining margins, which represent the difference between the cost of crude oil and the selling price of refined products, play a crucial role in determining stock prices.

Regulatory Changes: Changes in regulations, such as environmental policies and energy laws, can significantly impact the operations and profitability of oil refiners.

Global Economic Conditions: The global economic landscape, including factors such as GDP growth, inflation, and currency fluctuations, can influence the demand for refined products and, consequently, stock prices.

Case Studies

Exxon Mobil Corporation: In 2020, Exxon Mobil reported a significant increase in its refining margins, driven by higher crude oil prices and increased demand for refined products. This led to a surge in the company's stock price.

Valero Energy Corporation: In 2019, Valero Energy announced a strategic investment in a new refining facility, which helped the company enhance its refining capacity and improve its operational efficiency. This led to a positive response from investors, resulting in an increase in the company's stock price.

Conclusion

Investing in the largest US oil refiner stocks can be a lucrative opportunity for investors looking to capitalize on the energy sector. However, it is crucial to consider various factors, including crude oil prices, refining margins, and regulatory changes, before making investment decisions. By staying informed and analyzing market trends, investors can make well-informed decisions and potentially achieve significant returns.

SUBARU CORPORATION U/ADR: Exploring the Uni? Us stocks plummet