The current state of the US stock market is a topic of significant interest for investors and financial enthusiasts alike. As the world's largest stock market, the US stock market offers a glimpse into the economic health and future prospects of the nation. This article provides a comprehensive analysis of the current state of the US stock market, including key trends, market indicators, and potential risks.

Market Trends

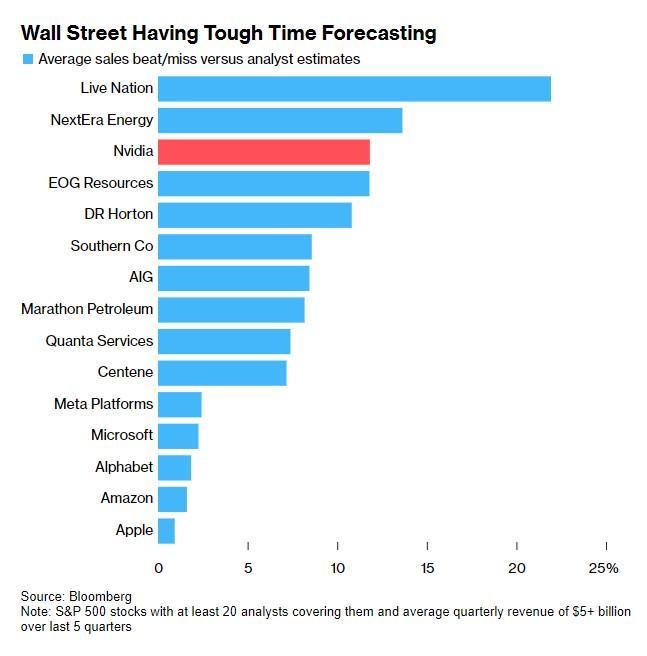

One of the most notable trends in the US stock market is the strong performance of technology stocks. Companies like Apple, Microsoft, and Amazon have seen significant growth in recent years, driven by their dominant positions in the tech industry. This trend has been further bolstered by the increasing adoption of cloud computing, artificial intelligence, and e-commerce.

Another significant trend is the rise of sustainable and socially responsible investing. Investors are increasingly looking for companies that prioritize environmental, social, and governance (ESG) factors. This has led to the growth of ESG-focused funds and the inclusion of ESG metrics in investment decisions.

Market Indicators

Several key indicators provide insights into the current state of the US stock market. The S&P 500 is a widely followed index that tracks the performance of 500 large companies listed on stock exchanges in the United States. As of early 2023, the S&P 500 has reached new record highs, reflecting strong market confidence and economic growth.

The NASDAQ Composite is another important index that tracks the performance of technology stocks. The NASDAQ has also reached new highs, driven by the strong performance of tech giants like Apple and Microsoft.

Potential Risks

Despite the strong performance, the US stock market is not without risks. One of the primary risks is inflation. The Federal Reserve has been raising interest rates to combat inflation, which could potentially slow economic growth and impact stock prices.

Another risk is the geopolitical situation. Tensions between the United States and other major economies, such as China, could lead to trade disputes and economic instability.

Case Studies

To illustrate the current state of the US stock market, let's look at two case studies.

Case Study 1: Tesla

Tesla, the electric vehicle manufacturer, has seen significant growth in recent years. The company's stock price has surged, driven by strong sales and increased production capacity. This growth reflects the increasing demand for electric vehicles and the company's leadership in the industry.

Case Study 2: Walmart

Walmart, the retail giant, has been adapting to the changing retail landscape. The company has invested heavily in e-commerce and supply chain optimization, which has helped it maintain its position as a market leader. Walmart's stock has also seen modest growth, reflecting the company's ability to adapt to new challenges.

In conclusion, the current state of the US stock market is characterized by strong performance in technology stocks and the rise of sustainable investing. However, investors should be aware of potential risks such as inflation and geopolitical tensions. By staying informed and monitoring key indicators, investors can make informed decisions in the US stock market.

YUE YUEN INDL UNSP/ADR Stock Gap Analysis: ? Us stocks plummet