In a stunning turn of events, the US stock market and bond yields have plummeted following a weak auction of government securities. This article delves into the reasons behind this sudden downturn and its potential implications for the economy.

Weak Auction Signals Market Concerns

The recent auction of US Treasury bonds, which saw a lower-than-expected demand, has sent shockwaves through the financial markets. This has led to a sell-off in stocks and a sharp decline in bond yields. Investors are increasingly concerned about the economic outlook and the Federal Reserve's policy stance.

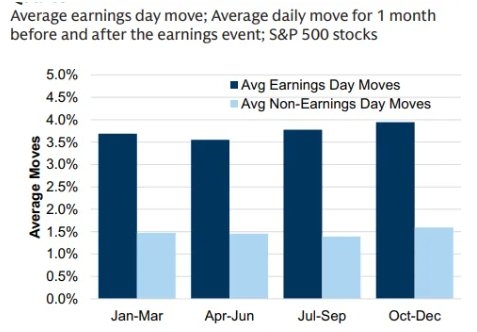

Stock Market Reactions

The stock market has been particularly sensitive to this development. Major indices, including the S&P 500 and the Dow Jones Industrial Average, have experienced significant declines. Tech stocks, which have been a major driver of the market's growth, have also taken a hit. This is largely due to concerns about rising interest rates and a potential slowdown in economic growth.

Bond Market Implications

The weak auction has also had a profound impact on the bond market. Yields on 10-year Treasury bonds have fallen to their lowest levels in months. This has prompted investors to seek alternative investments with higher yields, leading to a sell-off in corporate bonds and other fixed-income securities.

Economic Outlook Concerns

The weak auction and subsequent market sell-off are a clear sign that investors are increasingly concerned about the economic outlook. The US economy has been showing signs of slowing down, with recent data indicating a slowdown in consumer spending and business investment. This has raised concerns about the possibility of a recession in the near future.

Fed Policy Stance Under Scrutiny

The Federal Reserve's policy stance is also under scrutiny following the weak auction. Investors are closely watching for any indication that the Fed may be considering a more aggressive tightening of monetary policy. This has the potential to further dampen economic growth and lead to a deeper downturn in the stock and bond markets.

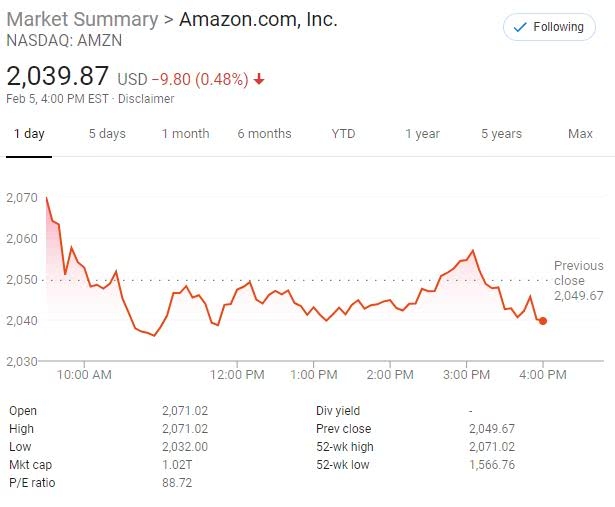

Case Study: Tech Sector Sell-off

One of the most notable impacts of the weak auction has been the sell-off in the tech sector. Companies like Apple, Microsoft, and Amazon have seen their share prices decline significantly. This is largely due to concerns about rising interest rates and a potential slowdown in consumer spending. The tech sector has been a major driver of the stock market's growth in recent years, and its decline is a clear sign that investors are becoming increasingly cautious.

Conclusion

The weak auction of US Treasury bonds and subsequent market sell-off have raised significant concerns about the economic outlook. Investors are increasingly concerned about the possibility of a recession and the Federal Reserve's policy stance. As the situation unfolds, it will be crucial for investors to closely monitor economic data and policy developments to make informed investment decisions.

REXEL SA ORD: A Comprehensive Guide to Unde? Us stocks plummet